Positive sentiment despite challenges ahead for the UK Hotel Market

Despite significant challenges ahead - with a return to 20% VAT on top of rising wage costs, food prices and the surging cost of energy - February’s trading yielded a robust recovery, more than recouping the previous month’s losses.

1 minute to read

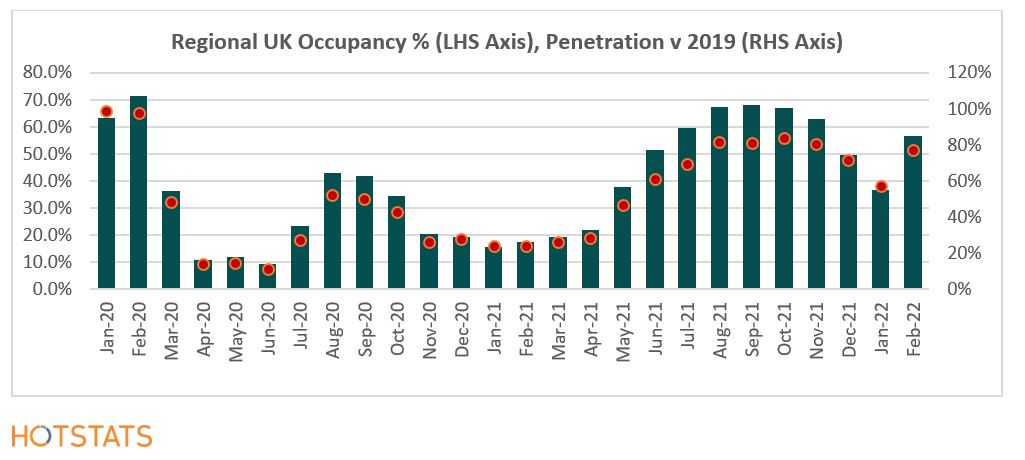

Improving Occupancy Levels - Leisure demand dominates but supported by increasing business demand

Both London and Regional UK witnessed a strong recovery in occupancy performance, with month-on-month growth of occupancy in February averaging 20 percentage points. London’s Year-to-Date (YTD) occupancy of 33.1% is ahead of the full-year occupancy achieved in 2021 of 28%, whilst YTD performance for regional UK matched the full-year 2021 occupancy of 45.3%.

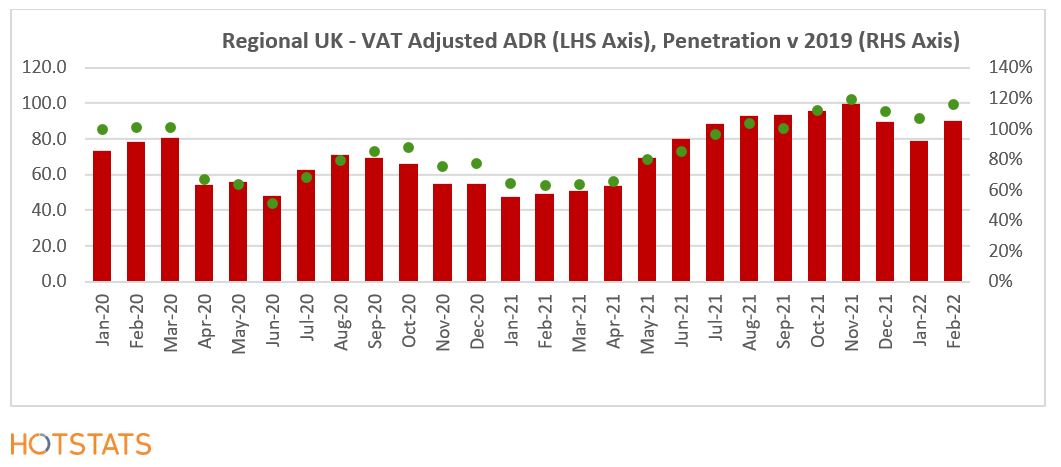

Prices rise in an inflationary environment

After adjustment for the temporary reduction in VAT, the Average Daily Room Rate (ADR) for Regional UK is currently some 16% ahead of the ADR as at February 2019. Meanwhile, London’s ADR is 11% ahead of its February 2019 performance. This is a clear indication that room rates are rising to counterbalance the rising costs and we expect this spread to widen as prices increase in an inflationary environment.

Chancellor’s Spring Statement Message – No guarantees of financial support ahead

The Chancellor’s Spring Statement brought disappointment for the UK Hotel sector, reinforcing the message that the government’s purse strings have now firmly closed, combined with the continuing tapering-off of existing government support.

Whilst the UK hotel market’s top-line revenue performance continues to recover following the setback of Omicron - still with RevPAR around 20% below the level recorded in November 2021 - the cost-of-living crisis and rising inflation, made worse as a result of Russia’s invasion of Ukraine, risks prolonging the route to a full recovery.

Download the latest Hotels Dashboard