Inflation is everywhere, supply shocked and a frosty welcome to the new Housing Minister

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Inflation everywhere

January's US consumer price index is a horror show for President Biden. The rate of inflation hit 7.5% in January, its highest rate for 40 years. Lift the lid and price rises have moved well beyond goods affected by the pandemic. Food, electricity and shelter were the largest contributors, chipping away at paychecks everywhere.

Republicans placed the blame on Biden's $1.9 trillion pandemic relief bill, passed without Republican support last March. The ten year treasury yield surpassed 2% for the first time since 2019 and Goldman Sachs now expects the Fed to hike rates seven times over the course of the year. Mortgage rates are at their highest level since January 2020.

Interestingly in the UK, where price gains were already pretty broad based due to Brexit, Bank of England chief economist Huw Pill appeared to walk back the market's expectations of a rise in the base rate to 1.2% by the end of the year, suggesting it could cause inflation to undershoot the 2% target. The ECB's chief economist also struck a cautious tone, suggesting domestic monetary policy isn't the right tool to deal with external supply shocks...we'll see.

About those supply shocks

Just how bad are the UK's supply chain problems? A little worse than other G7 economies, according Jennifer McKeown, head of the global economics service at Capital Economics.

We spoke to Jennifer and Justin Gaze, Knight Frank's joint head of residential development, for the latest edition of Intelligence Talks (listen here, or wherever you get your podcasts). Supplier delivery times and inventory-to-sales ratios all look bad, though the situation isn't as critical as it was. Still, inventories are lean and backlogs are huge, so the crunch will likely take at least another 6-12 months to unwind.

For the time being, the situation at both Chinese and US ports is improving, but China's zero Covid strategy still poses a significant risk of port closures. The UK relies heavily on China for building fittings. Much of our wood and structural steel comes from Europe.The housebuilders are also handling wage inflation - particularly in urban locations - which will take longer to resolve.

Building houses

Supply chain pressures haven't stopped the housebuilders from upping output, see Barratt and Redrow half year results this week. Barratt completed 14.4% more homes a week compared to the same period a year earlier. House price inflation continues to exceed build cost inflation, according to Redrow.

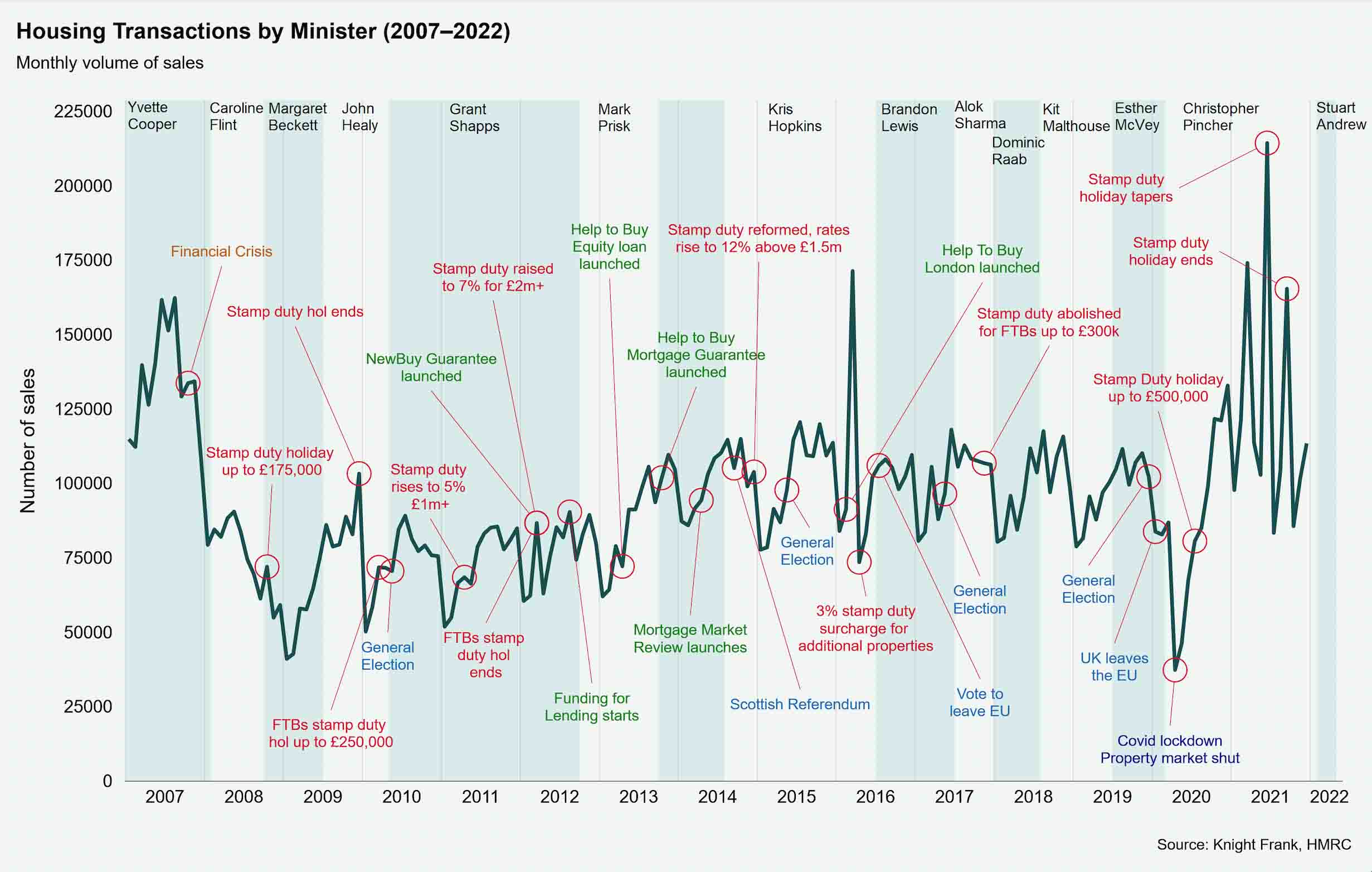

The arrival of Stuart Andrew as Housing Minister means we've updated the chart below, illustrating the UK's fluid policy environment when it comes to housing. Mr Andrew gets a frosty welcome from Wednesday's Times leader, which notes that he only needs to "hold his job as housing minister until October, having been appointed on Tuesday, to avoid being the shortest-serving of the 11 that have so far held that post since 2010."

Meanwhile, the leader points out that Andrew Griffith was last week appointed head of Downing Street’s policy unit. Mr Griffith led the rebellion against Boris Johnson's most recent attempt to reform the planning system - what was dubbed a “developers’ charter”. "It is safe to assume there is little chance of its return," the leader concludes.

Hotels

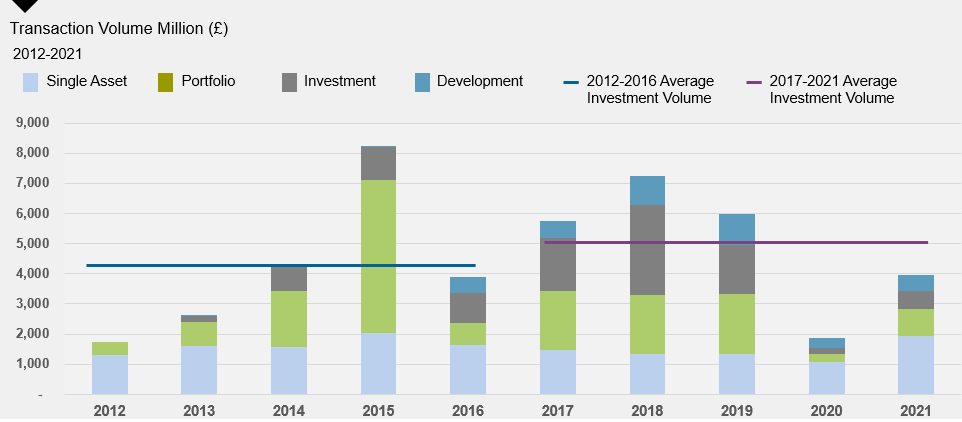

The UK hotel investment market staged a recovery in 2021, with £4 billion in transactions taking place over the course of the year.

The composition of transaction activity in 2021 was vastly altered compared to historical trends, according to Knight Frank analysis. In total, some 150 single asset hotel transactions took place with a guide price of over £2 million, equating to approximately £1.9 billion (see chart). That's the highest level of single asset activity to take place since the record-breaking year for hotel investment in 2015.

This level of investment demonstrates that the pandemic has acted as a catalyst for hotel transactions taking place at the lower end of the market, with a diverse range of investors, both domestic and from overseas. Strong domestic leisure demand has resulted in an exceptional level of distinctive assets being sold, in terms of their unique location, heritage, building fabric, history and positioning relative to their local environment. For more, see the full analysis.

In other news...

New figures from Chris Druce reveal that 9% of properties purchased during 2021 were bought by buyers that only viewed them once.

Elsewhere - Confederate street names bring lower house prices in the US (Bloomberg), ‘net zero’ plans by some of world’s biggest companies accused of falling short (FT), Brussels curbs growth forecasts as inflation hits EU economy (FT), Andrew Bailey calls for indefinite waiver on EU lenders’ access to London clearing (FT), 'End of the road' for euro clearing in London after June 2025, says EU official (Reuters), working from home is now a permanent fixture, say bosses (Times) and finally, US landlord Hines appoints co-CEO to focus on diversity and emissions (FT).