UK rural property: Budgeting for success

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

9 minutes to read

Opinion

It’s great news that the taxman has finally agreed that land put into environmental schemes will still qualify for Agricultural Property Relief (APR), a valuable tax-planning tool for farms and estates. The question is though why didn’t the wonks at Defra and other government departments foresee this could be an issue when they started encouraging rural property owners to seek out new green income streams from their land? Everybody knows that, rightly or wrongly, tax is often the tail that wags the dog, especially when it comes to loathed taxes like inheritance tax. The government has lofty environmental aspirations, some more joined up thinking will help deliver them more quickly.

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update directly to your email here.

Andrew Shirley Head of Rural Research

In this week's update:

• Commodities – Beef and milk set fair

• Budget 1 – Tax boost for nature farming

• Budget 2 – Best of the rest

• Hedgerows – Regulations renewed

• Rural Wales – Productivity report released

• Farmland – Food still no 1 investment

• Red tractor – Green scheme kyboshed

• Out and about – Low carbon farming

• Ozzie rules – Down under opportunity

• The Wealth Report – Out now

• Development land – Market stabilises.

• Farmland prices – 2023 ends on a high

• Country houses – 2023 better than expected

• The Rural Report – Watch the videos

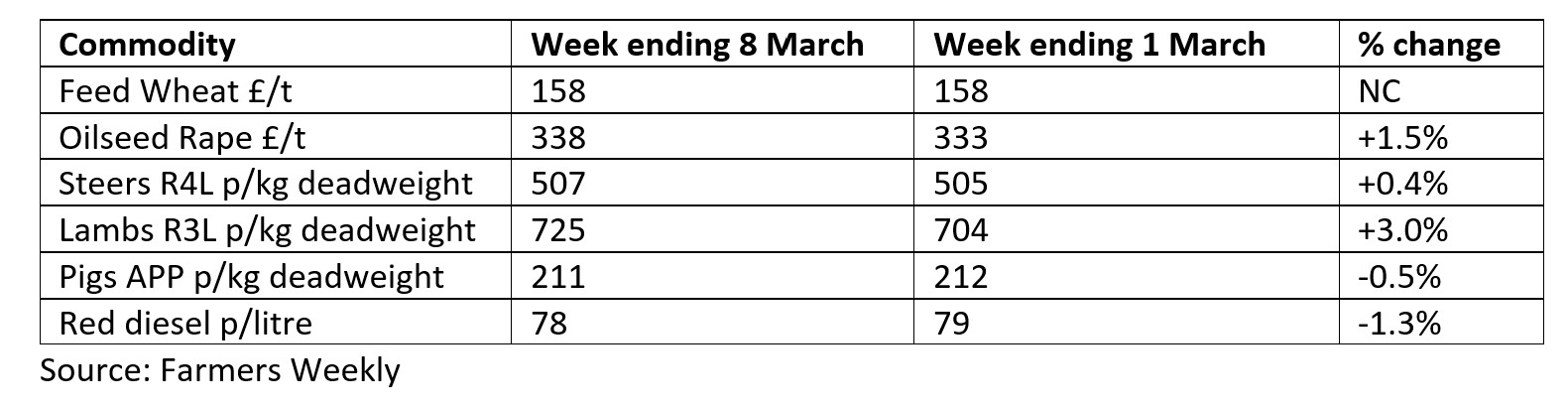

Commodity markets

Commodities – Beef and milk set fair

Tight supply and firm demand are likely to support beef prices for the rest of the year, according to analysts. Stronger gains could also be on the cards if China’s economic recovery is better than expected. Meanwhile, milk prices look set to be heading in the right direction after a torrid 2023. The white stuff peaked at 51.5p/litre in December 2022, but then slumped to a low of 35.67p/litre in July. As reported in Farmers Weekly, dairy farmers supplying Arla will receive over 40p/litre from March with other buyers also announcing spring price rises.

Need to Know

Budget 1 – Tax boost for nature farming

The big news for many farmers and landowners in last Wednesday’s budget was the announcement that land put into environmental schemes will still qualify for Agricultural Property Relief (APR), although not Business Property Relief (BPR), on inheritance. Many are keen to use some of their land for schemes such as Biodiversity Net Gain, but have been worried that they would lose valuable tax reliefs by doing so.

But based on the results of an industry consultation, an HMRC statement said it would: “extend the existing scope of agricultural property relief from 6 April 2025 to land managed under an environmental agreement with, or on behalf of, the UK government, Devolved Administrations, public bodies, local authorities, or approved responsible bodies”. It also plans “establish a joint HM Treasury and HMRC working group with industry representatives to identify solutions that provide clarity on the taxation of ecosystem service markets where existing law or guidance may not provide sufficient clarity.” HMRC has also decided not to act on a suggestion from the Rock Report to restrict agricultural property relief to tenancies of at least eight years.

For advice on environmental schemes and nature-based solutions please contact our Rural Consultancy experts.

Consultation Outcome - Taxation of environmental land management and ecosystem service markets

Budget 2 – Best of the rest

As predicted last week, Chancellor Jeremy Hunt also announced the scrapping, from April next year, of the non-dom rules that allow foreign residents who live in the UK to not pay tax on their overseas’ income for 15 years. Some commentators have already suggested that the “exodus” of the super-rich that they feel will undoubtedly ensue will cost the government more than it saves. Others ask if people are only living here for the tax perks do we really want them? The tax benefits of renting on short-term holiday lets were also scrapped. This is ostensibly to provide more accommodation for local residents instead of tourists, but could be a blow to some estates in holiday hotspots that rely on the income from visitors. For more details on these and other announcements, including the abolition of multiple-dwelling stamp duty relief, please read my research colleague Tom Bill’s Budget round up.

Hedgerows – Regulations renewed

Following a public consultation Defra has announced that hedgerows will enjoy the same level of protection they enjoyed while the UK was part of the EU. Based on the 9,000 or so responses, the proposed regulations will replicate the approach already familiar to most farmers from the previous cross compliance rules. As before, they will require a two-metre buffer strip measured from the centre of the hedge, where no cultivation or application of pesticides or fertilisers must happen.

Hedge cutting will also be banned between 1 March and 31 August to protect nesting birds. Enforcement of the rules, however, will be different says Defra. It will be consulting on a more “fair and proportionate” approach. “We have learned lessons from previous approaches and believe an advice-led approach will result in the best outcomes.”

Talking points

Rural Wales – Productivity report released

A new report from the Welsh Senedd’s Rural Growth cross-party group has just been published. Produced for the group by CLA Cymru, Generating Growth in the Rural Economy: an inquiry into Rural Productivity in Wales makes 19 recommendations in four key areas: Infrastructure and connectivity; Housing and planning; Tourism; Food production and the supply chain. One of the key recommendations is a review of the terms – and clarity of the funding rates – within the proposed Sustainable Farming Scheme (SFS) to ensure it can continue to support this fundamental pillar of the rural economy is truly sustainable. The recommendation includes a demand for greater flexibility on the proposals to commit farms to 10% cover of trees and habitats. Productivity in Wales as a whole is 16% lower than the UK average, while workers in rural Wales are up to 35% less productive than in urban areas.

Farmland – Food still no 1 investment

Food production is still the primary reason for investing in farmland, according to a global survey of wealth advisors. Almost 50% of respondents to The Wealth Report Attitudes Survey, produced by Knight Frank, said producing food was a good reason to invest in agricultural land. However, 41% said the environmental benefits on offer were also an opportunity. Read the full article for more insight and data and my thoughts on the market for natural capital.

Red tractor – Green scheme kyboshed

The future of the Red Tractor farm assurance scheme’s proposed new green module now looks in doubt. Farming unions have called for the controversial Greener Farms Commitment (GFC), which would enable retailers to show food with the Red Tractor logo was produced to certain environmental standards, to be scrapped. Some farmers have also threated to boycott Red Tractor if they proceed with it. Although the commitment was intended to be a voluntary bolt-on, farmers fear it will eventually become mandatory and will allow supermarkets to burnish their green credentials without paying farmers any extra for the food they produce.

Out and about – Low carbon farming

Net zero isn't just a buzzword—it's a call for action that requires a holistic approach. That was the key message from the Low Carbon Agriculture event last week attended by my agri-consultancy colleague Mark Topliff. “Seminar speakers said let's forget the jargon; let's talk about slashing costs and fortifying businesses. And it shouldn't just fall on farmers' shoulders.

There was agreement that we need governments, stakeholders, and farmers in the same boat, rowing towards a sustainable horizon. When it came to regenerative farming, many panellists said it was the way forward. Livestock? They're part of the solution, not the problem. The event also showcased innovations on the land manager and farmer's side, from carbon audit software to methane-suppressant feed products.”

Property News

Ozzie rules – Down under opportunity

Fancy better weather? Fed up of farming in the UK? Then Kellie Morris of our Tasmanian farm sales’ team has a 400-acre mixed-farming opportunity in Weegena on the north-west of the island that could be of interest. “Glenferrie boasts an impressive array of unique opportunities such as cropping with fresh soil, as it’s been under pasture for many years. It has historically operated as an intensive dairying and grazing enterprise ideally suited for winter milking,” says Kellie

Our Latest Property Research

The Wealth Report – Out now

The 2024 edition of The Wealth Report, Knight Frank’s leading piece of thought leadership on global wealth and property trends is out now. This instalment of the report includes the latest wealth creation data – spoiler, there are more rich people – and and article by yours truly on global farmland markets and how they are being influenced by ESG and Natural Capital. Download your copy.

Development land – Market stabilises.

Newly released figures from the Knight Frank Residential Land Index show that England greenfield and urban brownfield values were flat in Q4 2023 compared with the previous quarter. Previously, urban brownfield values had fallen by 20% since the most recent peak of the market in the first quarter of 2022 up to Q3 last year, with greenfield down 17% during the same period. Greater economic confidence and a slowdown in the rise of build costs helped underpin values, says my colleague Anna Ward. Read her full report for more numbers and insight.

Farmland prices – 2023 ends on a high

The Q4 2023 instalment of the Knight Frank Farmland Index has now been published. The average value of bare agricultural land rose by 2% in the final quarter of the year to break the £9,000/acre barrier for the first time. Annual growth was 7%, which outperformed a number of other asset classes. Our research suggests values may flatten out this year, but supply remains limited and demand robust. Read the full report for more insight and analysis.

Country houses – 2023 better than expected

Kate Everett-Allen, our international residential research guru, has added the country homes market to her portfolio and has a bit of good news to report. “Prime country house prices declined by 5.8% in 2023. While this figure represented a sizable correction after two stellar years of growth, the rate of decline was lower than our forecast of -7% for the year. A growing sense that mortgage rates are at, or close to their peak, began to influence market sentiment towards the end of the quarter – a theme we expect to build this year. That’s not to say prices and sales volumes will bounce back strongly. Although the Bank of England opted to hold interest rates at 5.25% in December, the cost of borrowing remains at a 15-year high.” Read Kate’s full report.

The Rural Report – Watch the videos!

You've read the book, now watch the videos! To complement the thought-provoking articles contained within the 2023/2024 edition of The Rural Report our whizzy Marketing team has also created a series of videos featuring many of the report's contributors. Head to our very own YouTube channel to discover more about biodiversity net gain and regenerative farming; find out how we are helping Guy Ritchie's Ashcombe Estate on its diversification journey; and read about the travails of an entrepreneurial Zimbabwean searching for a farm for his family. Plus, lots more.