UK rural property: 2023 - the year of the environment?

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

12 minutes to read

Opinion

Many farmers and growers will be glad to see the back of 2023. Regular social media commentators say it has been one of the toughest growing seasons they have ever known. The resilience of any farm and estate is tested when one month is the driest on record, followed by one of the wettest. On top of this was the launch of a raft of environmental laws, policies and papers. Changes to the English environmental schemes got a mixed response, while the Scottish and Welsh were left wondering where their ag policies were heading. During a rain-soaked autumn, the government unleashed a deluge of more policies and schemes. And Rishi Sunak decided the UK was moving too quickly in its net zero journey, rolling back several targets. From weather volatility to environmental policy uncertainty, the rural sector has had to endure a lot this year. But maybe this will be the year we look back on and say it was when a significant shift happened. Its challenges and opportunities meant that attitudes, perceptions, and approaches changed. Let's raise our glasses to a more resilient and prosperous rural future MT

As Andrew is taking a much-earned break, I have taken over the Rural Update this week. However, this will be my last as I join the Rural Consultancy team next year. Andrew and I hope you've found the Rural Update thought-provoking and useful throughout 2023. It will be back in 2024, but in the meantime, have a fantastic Christmas break, however and wherever you are celebrating - Mark

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update direct to your email here

Andrew Shirley, Head of Rural Research; Mark Topliff, Rural Research Associate

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

In this week's update:

• Commodity markets – A volatile year

• Planning – Framework revision gets mixed response

• Interest rates – Higher for longer?

• Food inflation – Rates continue to slow

• Trees 1 – Largest native wood experiment

• Greenwashing – New rules for asset managers

• Imported fertiliser – Carbon levy announced

• International news – German farmers' mass protest

• Ag machinery – Evidence calls for net zero ambitions

• Trees 2 – New roadmap for homegrown timber

• Vineyards – Keep abreast of the latest sales

• Land at Simonsbath – Rare piece of Exmoor for sale

• Development land – Prices still falling

• Country houses – Prices drop

• Farmland prices – Market at peak?

• The Rural Report – Watch the videos

Commodity markets

Commodities – A year of up horn, down corn

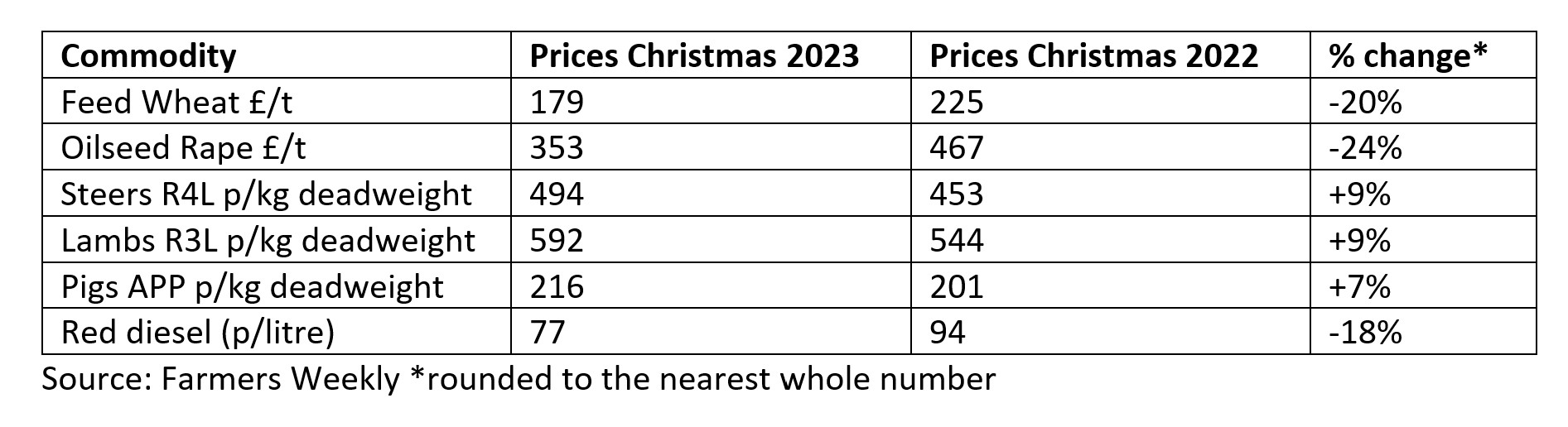

A scan back at how commodity prices changed over the course of 2023 highlights some opposing trends. Finished livestock prices were the winners, with values up around 7% to 9%. But arable growers will wonder what happened this year, with cereal and oilseed prices down around 20%. Dairy producers will also be lacking some festive spirit, with year-on-year milk prices down around 13p per litre in many cases.

However, some comfort has come in the form of lower input prices, particularly diesel and fertiliser. But this is not going to see the costs of production back to former levels. Even if variable costs fall, overhead costs are harder to budge, with fuel, labour, and finance costs likely to stay relatively high in 2024 MT

Talking points

Planning – Framework revised to mixed response

Planning is not an area that is necessarily known for its clear guidance, but it was hoped that a revised National Planning Policy Framework might help. The updated version has provided clearer workability in many areas but still retains policies that oppose each other. Green Belt protection sees softer wording, and there is now no requirement for local planning authorities (LPAs) to alter boundaries to deliver housing. However, a large proportion of the authorities to which the urban uplift applies – a requirement to deliver homes on brownfield sites - are constrained by Green Belt. Another notable change is the requirement for LPAs to maintain a rolling 5-year housing land supply is eliminated, provided certain conditions are met.

Also, from a rural perspective, a footnote in the framework stresses the importance of land for food production. This might be an important amendment which is likely to generate a whole load of appeal arguments for rural LPAs.

In a bid to hold the whole housing sector accountable and distract from government policy failings, the Secretary of State announced some stringent measures. These included intervening in seven councils and promising consultations on time extensions, LPA performance league tables, and statutory consultees. Good news, though, is the Planning Skills Delivery Fund, which has been awarded to support local authorities with planning backlogs and skills development. Let's hope it makes a difference MT

Interest rates – Higher for longer?

Last week, the Bank of England (BoE) kept the base rate unchanged at 5.25%, the highest in 15 years. What was interesting (excuse the pun) was that three members of the Monetary Policy Committee wanted to increase it further. The BoE remain fairly pessimistic on where rates will go in 2024, while investors foresee several rate reductions. Tom Bill, Head of Residential Research for Knight Frank, points out that "there is more downward pressure on mortgage rates than the Bank of England has indicated." Read the latest from the research team on where rates could head in 2024 MT

Food inflation – Rates continue to slow

Talking of rates, Britain experienced a welcome respite from its two-year cost of living crisis, with November witnessing an unexpected significant drop in the annual inflation rate to 3.9%. Cheaper petrol, down four pence per litre, was pivotal in driving the headline rate below 4%, while food prices, notably bread and cakes, rose more slowly.

Although overall food prices increased by 0.3% monthly, the annual rise of 9.2% in November reflected a slight improvement from October's 10.1%. The Office for National Statistics (ONS) emphasised a 27% increase in the cost of food and non-alcoholic beverages over the past two years, compared to a 9% rise between November 2011 and November 2021 MT

Trees 1 – Largest native wood experiment

Located in North Yorkshire's Snaizeholme, tens of thousands of saplings covering 291 hectares, promise to transform into one of England's largest native woodlands, starting a colossal, decades-long experiment. Beyond enhancing the region's scenic beauty, the expansive hillside project aims to combat flooding in villages below. This monumental scientific endeavour spans two decades, scrutinising various factors, from lightning strikes to stream velocity, soil density, and the symbiotic relationships between trees, wildlife, and fungi. The Woodland Trust project at Snaizeholme is supported by several corporate partners - Aviva, B&Q, Screwfix, Bettys & Taylors Group of Harrogate. Snaizeholme will be the most extensive scientific research initiative ever embarked upon in England's uplands MT

Greenwashing – New rules for asset managers

Continuing the environmental theme, the Financial Conduct Authority (FCA) - authorised companies face new Sustainability Disclosure Requirements (SDR) starting next year. Asset managers must avoid vague sustainability marketing and choose specific fund labels like 'Sustainability Focus,' 'Sustainability Improvers,' 'Sustainability Impact,' or 'Sustainability Mixed Goals.' These labels are meant to ensure clear information and a minimum 70% allocation supporting the chosen label.

Notably, 'Sustainability Improvers' focuses on assets with potential long-term impact improvement, while 'Sustainability Impact' aligns with impact investing principles. The move aims to address concerns over exaggerated sustainability claims and provide transparency for customers in the evolving sustainable investing market.

What does this mean for the rural sector? The implication of these labels could trickle down to the natural capital markets.

Institutional investors will be required to be clearer about what they have invested in, such as nature-based ventures, including schemes like Snaizeholme above or biodiversity projects. These projects will need to show their benefits using robust methodologies to ultimately support the FCA labels. It highlights the importance of having a good baselining and monitoring partner when entering your land into a natural capital market if you are looking to attract private finance MT

Imported fertiliser – Carbon levy announced

Fertiliser imports could be hit with a higher carbon levy in three years' time to put it on an equal footing to domestically produced products. The UK government has announced the implementation of the UK Carbon Border Adjustment Mechanism (UK-CBAM) by 2027, imposing a levy on certain imported goods from countries with lower or no carbon pricing. As well as fertiliser, this move aims to ensure that carbon-intensive products in sectors such as iron, steel, aluminium, hydrogen, ceramics, glass, and cement face a carbon price comparable to that produced domestically. The initiative follows the EU's CBAM, set to be in full effect by 2026, and aims to address carbon leakage and prevent the displacement of production and emissions to countries with lower carbon prices MT

International news – German farmers' mass protest

It's not just the French who can do a good protest march. German farmers, rallying against proposed budget cuts affecting them, converged on Berlin with around 3,000 tractors, encircling the iconic Brandenburg Gate. The demonstrators oppose the government's plan to eliminate tax privileges and subsidies enjoyed by farmers, a move justified by the government to safeguard the climate. The proposed changes include ending tax breaks for diesel used in farming and eliminating car tax exemptions for agricultural vehicles. The movement echoes similar protests across Europe, responding to the government's efforts to reduce agricultural greenhouse gas emissions MT

Need to Know

Ag machinery – Evidence call for net zero ambitions

To the relief of the UK farming sector currently there are no plans to scrap lower fuel duties but instead the government are seeking evidence on how non-road mobile machinery (NRMM), like tractors and other agricultural machinery, might decarbonise as part of the government's wider net zero ambitions. The focus of the Call for Evidence is to gather evidence regarding NRMM use, potential decarbonization methods (efficiency measures, process changes, fuel switching), and any associated opportunities and obstacles. The call will also assess if existing policies align with net-zero goals and if Industrial Decarbonisation Strategy principles should guide further government intervention for NRMM decarbonization. Farmers are encouraged to contribute insights for shaping effective policies in this vital sector MT

Trees 2 – New roadmap for homegrown timber

If forestry means more to you than experiments and flood prevention, you may be keen to know that the government has unveiled an ambitious roadmap to boost timber utilisation in home and building construction. The aim is to cut UK emissions and achieve net-zero targets, and timber construction proves effective, reducing building emissions significantly. With 25% of UK greenhouse gas emissions from the built environment, engineered timber buildings store up to 400% more carbon than concrete structures.

The plan, revealed after COP28 urbanization discussions, outlines goals for increased timber use, offering economic growth, rural job opportunities, and levelling up. Key actions include enhancing timber data, advocating timber as a construction material, and addressing fire safety concerns for expanded engineered timber use. If the roadmap boosts what it says it will, then farms and estates may see greater incentives to grow trees for the timber industry MT

Vineyards – Keep abreast of the latest sales

Ed Mansel Lewis heads up Knight Frank's Viticulture consultancy and is at the sharp front of what is happening in the industry. He says: "We generally know about the most important and exciting deals weeks before they are announced and are connected to the most influential people in the industry."

Ed is creating an email distribution list that will give readers the inside scoop on any sales, joint ventures, and investment opportunities that Knight Frank is involved in. If you would like to be included in this distribution list, please email Bertie Gilliat-Smith MT

On the market

Land at Simonsbath – Rare piece of Exmoor for sale

Our Farms & Estates and Bristol team are selling approximately 390 acres of pasture, improvable grazing land and moorland in Exmoor National Park near Simonsbath, Somerset. The land is in a private location and offers opportunities for existing traditional farming as well as for natural capital and nature recovery. The guide price is £1.77 million. Contact Will Matthews or John Williams for further information MT

Our Latest Property Research

Development land – Prices still falling

The latest findings from our Residential Development Land Index show values are continuing to fall. "UK greenfield and urban brownfield values fell on average by 2.4% and 2% respectively in Q3 2023. In prime central London, land prices were flat during the quarter," writes my colleague Anna Ward. "Average urban brownfield land values across England have now fallen by 20% since the most recent peak of the market in the first quarter of 2022 up to Q3 this year, with greenfield values down 17% during this period. But this quarter we have seen price falls start to moderate in nearly all areas," adds Anna AS

Country houses – prices drop

The value of a home in the countryside is falling at the fastest rate since the global financial crisis, according to the latest instalment of the Knight Frank Prime Country House Index compiled by Chris Druce. In Q3 2023 average prices dropped by just over 2% taking the 12-month slide to over 8%. Despite the slump, values are still 12% higher than they were in June 2020. Chris says there is a bit of stalemate in the market as sellers cling to last year's prices, while purchasers are angling for big discounts. Read the full report AS

Farmland prices – Market at peak?

The latest edition of The Knight Frank Farmland Index has now been published. The average value of bare agricultural land rose by 1% in the third quarter of the year to just shy of £9,000/acre. Annual growth was 8%, which outperformed a number of other asset classes (see chart). Our research suggests values may remain flat into 2024. Read the full report for more insight and analysis AS

The Rural Report – Watch the videos!

You've read the book, now watch the videos! To complement the thought-provoking articles contained within this year's edition of The Rural Report our whizzy Marketing team has also created a series of videos featuring many of the report's contributors. Head to our very own YouTube channel to discover more about biodiversity net gain and regenerative farming; find out how we are helping Guy Ritchie's Ashcombe Estate on its diversification journey; and read about the travails of an entrepreneurial Zimbabwean searching for a farm for his family. Plus, lots more AS