A Year of Re-balancing in the Prime London Lettings Market

December 2023 PCL lettings index: 218.7

December 2023 POL lettings index: 220.5

3 minutes to read

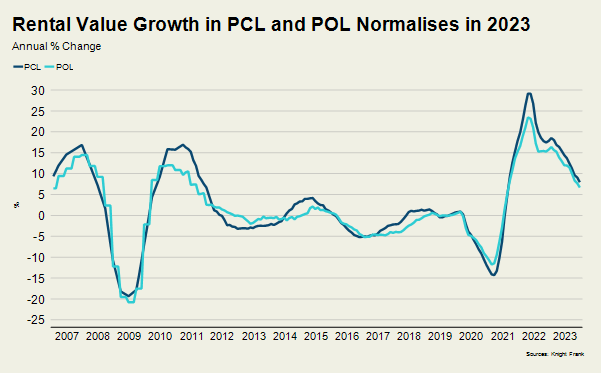

Rental value growth more than halved in prime central and prime outer London over the course of 2023.

The figures still aren’t close to their long-term norms, but 2023 was the year the convulsions caused by the pandemic in the prime London lettings market began to dissipate.

Rental value growth in PCL peaked at 29% in April 2022, up from a low-point that had been created by the arrival of short-let rental stock during the pandemic, when Airbnb stays were banned.

The only equivalent movement in recent years was a fall of 19% in June 2009 following the global financial crisis, as the chart below shows.

Average annual growth ended the year at 7.9% in prime central London and 6.7% in prime outer London. The figures compare to our forecast of 8% for both markets made in October.

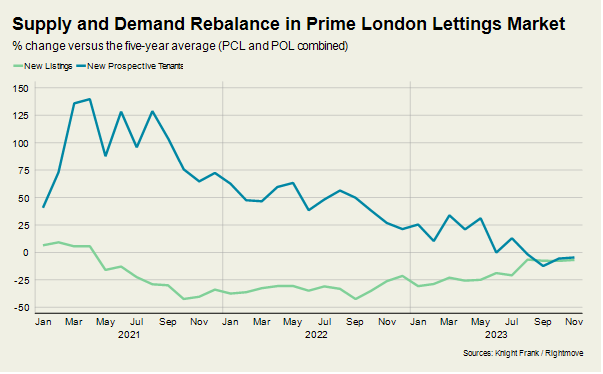

Landlords have left the sector in recent years due to extra red tape and taxes, which put strong upwards pressure on rental values. However, supply is recovering as demand is gradually absorbed and more sellers become landlords in a sales market where prices are weak.

New rental listings were only 7% below the five-year average in November in prime central and outer London, Rightmove data shows. That has narrowed significantly from a decline of more than a third throughout most of 2022.

Meanwhile, the number of new prospective tenants fell to 5% below the five-year average in November, a figure that was more than a third higher for most of 2022, as the chart shows.

The ratio of new prospective tenants (demand) to new lettings listings (supply) has fallen further in higher-value markets as owners are typically more discretionary and able to let rather than sell if the sales market is showing signs of weakness.

The ratio was 4.7 for properties valued under £1,000 per week in London in November while it was 2.8 above that figure. As a result, rental value growth in PCL above £2,000 per week was 7.1% in PCL and 3.4% in POL, both below the average.

Unfortunately for landlords and tenants, the regulatory uncertainty is likely to extend into 2024.

It’s true that average rents in PCL are 32% higher than they were before the pandemic while the equivalent increase is 28% in POL.

Higher rents and a relatively weak sales market also mean yields are rising. The average gross yield in PCL in December was 4.2%, which compares to 3.42% before the pandemic.

However, while this will attract some landlords, rising mortgage costs, tax and red tape should keep downwards pressure on supply. Next year’s general election will only add to the sense of uncertainty.

The Renters Reform Bill, which is currently going through Parliament, has involved a discussion over the abolition of Section 21 no-fault evictions and whether this must wait until the courts are ready to cope with the workload.

While this itself creates an element of ambiguity, an incoming Labour government could abolish no-fault evictions whether the courts are ready or not.

A change in government could also see the goalposts move in areas including energy efficiency. The one safe bet is that a Labour government would not introduce rent controls, having publicly ruled them out.

The uncertainty means rents will only keep rising in 2024. The good news for tenants is that the increases won’t be as large as this year.