Decline in UK house prices reverses in October

Activity subdued in the residential property market despite interest rate hike pause.

3 minutes to read

There was an end to house price declines in October, although this was perhaps a consequence of weak activity rather than a reversal of fortunes for the sector.

Halifax said average prices climbed 1.1% in October, breaking a run of six consecutive falls. It took the annual decline to -3.2%.

“Prospective sellers appear to be taking a cautious attitude, leading to a low supply of homes for sale. This is likely to have strengthened prices in the short-term, rather than prices being driven by buyer demand, which remains weak overall,” said Kim Kinnaird, director, Halifax Mortgages.

Nationwide said UK house prices had increased by 0.9% in October, which left the annual rate of decline at -3.3%.

While sales volumes remain low, it is wise not to over-interpret one month’s data. A smaller sample size can affect the result, as we’ve explored previously.

The 85,600 UK residential property transactions in September 2023 represented a fall of 17% on September last year.

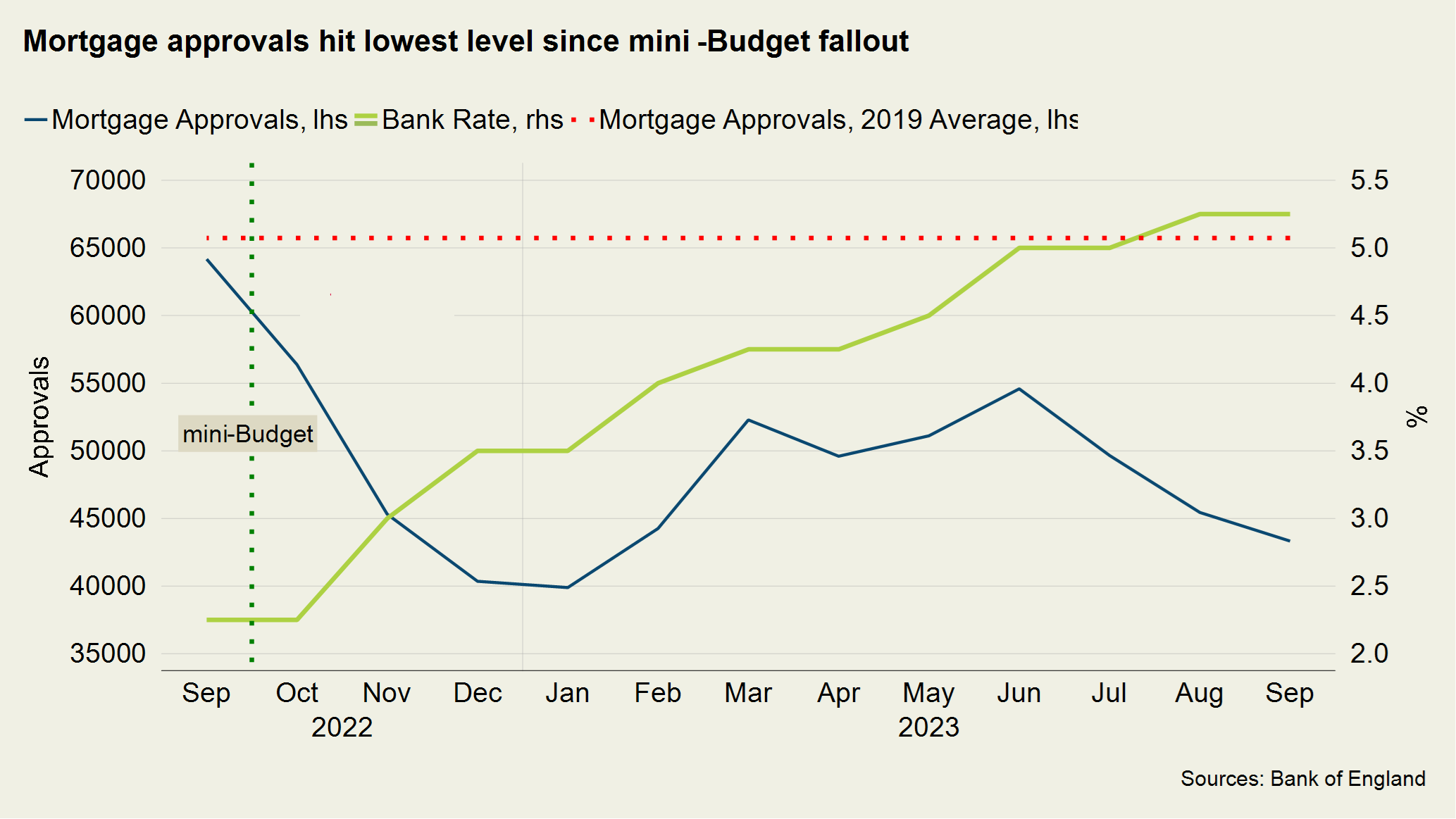

Furthermore, there were 43,300 mortgage approvals in September, down from 45,500 in August (see chart).

Although the Bank of England (BoE) held interest rates at 5.25% for a second consecutive month at the start of November, demand remains weak as buyers and sellers adapt to the increased cost of borrowing.

With the BoE stating that UK GDP growth is likely to be minimal next year and the UK economy flatlining in Q3, some say that UK interest rates have peaked.

However, stretched borrowers are unlikely to see immediate relief with the BoE also reiterating that interest rates will be held at their current level for some time in a bid to squeeze inflation out of the system.

There are some signs of strain as borrowers continue to roll off their fixed-rate mortgages on to more expensive deals.

There were 87,930 homeowner mortgages in arrears in Q3 2023, 7% more than the previous quarter, according to UK Finance. The number is still low by recent historical standards.

Prime London Sales

Activity in prime central and outer London this October was similar to the same month in 2022, a moment of high uncertainty after the mini-Budget caused a spike in rates and the widespread withdrawal of mortgage products.

The number of new prospective buyers registering in London was only 1.2% higher, exchanges were 2.2% higher and the number of viewings was 1.4% lower.

A greater proportion of cash buyers and higher levels of housing equity help protect prime London markets to some degree, but they have less effect on overall sentiment, which remains weak.

Prime London Sales Report - October 2023

Prime London Lettings

Normality appeared on the horizon in the prime London rental market in October.

High demand and low supply have pushed up rental values at unprecedented rates over the last two years, but the financial pain for tenants is reducing as the market re-balances.

Average rents in prime central (9.6%) and outer London (8.3%) both grew by less than 10% in the year to October, the first time the annual rate has been in single digits since September 2021.

Furthermore, there was no monthly change to average rents in either market, the first time they have been flat since April 2021.

Overall, the supply of lettings property in prime London was 0.6% higher than in 2019. Meanwhile, the number of new prospective tenants has calmed down in recent months.

Prime London Lettings Report - October 2023

Country market

Sentiment will improve in the Country market if rates have indeed peaked, but for now sales volumes remain under pressure.

The size of the gulf between buyers and sellers in relation to price expectations means fewer deals are happening than a year ago.

Offers made were down by 13% in October versus the five-year average, and exchanges by more than a third (34%).