Investing in Aspen's red-hot property market: our expert insights

Douglas Elliman’s top brokers in Aspen Snowmass breakdown the top investor opportunities in this exclusive market.

4 minutes to read

This article forms part of the Ski Property Report 2024 series giving insight into the latest market trends, property data and investment volumes across key ski locations.

Experts at our partner Douglas Elliman, Knight Frank’s residential partners in the US, Riley Warwick (RW), Melanie Muss (MM), and Raifie Bass(RB) provide their thoughts on current market conditions.

1. How has the Aspen/Snowmass market changed in the last 12 months and what impact have higher interest rates had on the market?

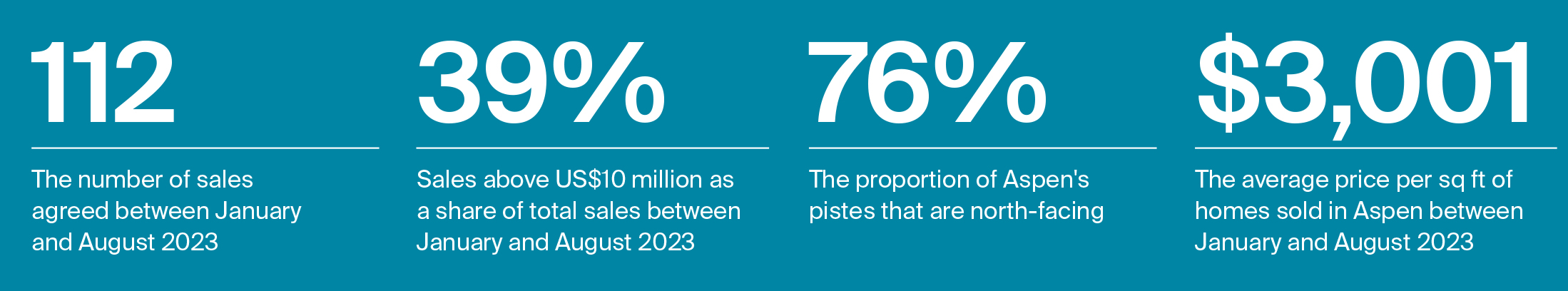

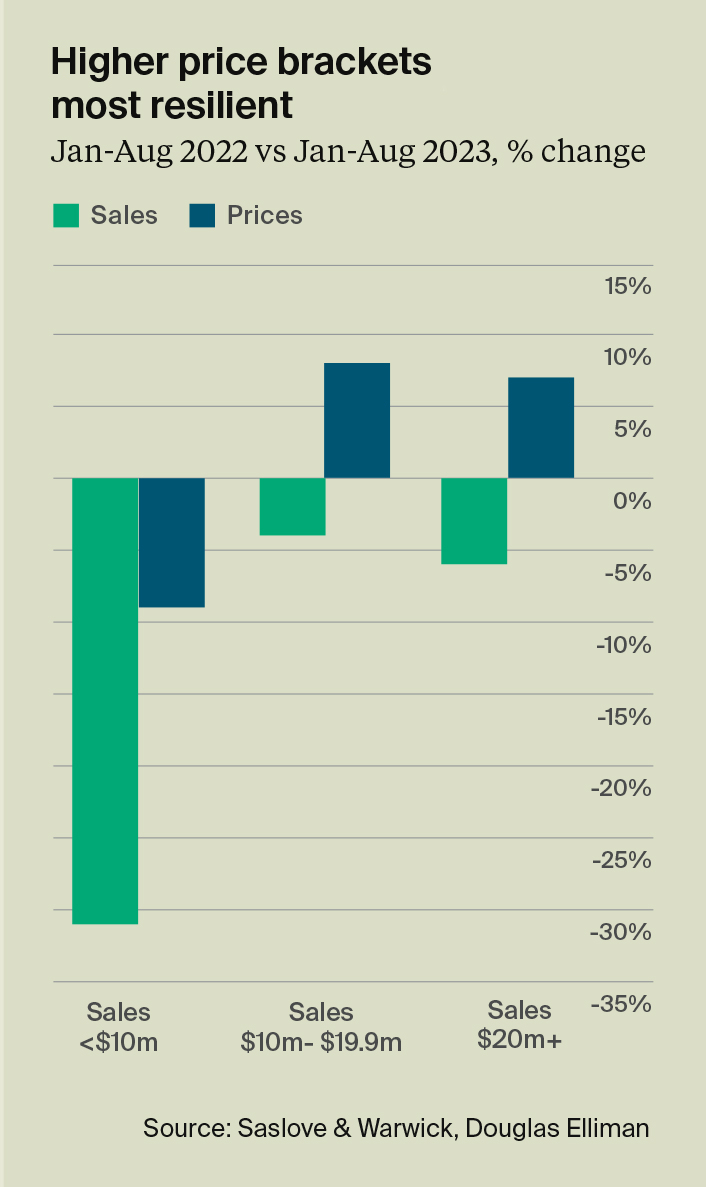

RW: The market is generally flat year-on-year in terms of the number of transactions and average price per sq. ft. The exception is below US$10 million, which saw sales decrease 31% on an annual basis and a 9% decrease in prices.

MM: The market, which is not influenced by interest rate shifts, has remained quite strong over the last 12 months, with Snowmass Base Village seeing a lot of activity.

RB: While the market volume is down from the crazy Covid peak, it is still very strong and in line with pre-Covid markets of 2018 and 2019. Higher interest rates seemingly have had little to no effect on the high end, as the majority of our closings, around 80%, are cash.

2. Which neighbourhoods and/or price bands are seeing the most activity?

RW: As always, Aspen’s Central Core, West End and Red Mountain are seeing the most activity. Snowmass has also seen a pick up in activity due to its lower price point relative to Aspen.

MM: Proximity to the downtown core is always in demand, as is Red Mountain. There continues to be buyers for unique high-end properties with many changing hands off market.

RB: The ultra-luxury market is stronger than ever. As it continues to get more difficult and more expensive to build here, buyers show a willingness to pay record prices for turn-key homes.

3. A lack of stock has been the overriding story since the pandemic. Is this still a factor, and if so, when do you see this changing?

RW: Inventory has grown over the last nine months or so to a healthier level, but we are still below 2019 levels. This is creating upward pressure on prices, especially in Snowmass Village.

MM: While inventory is up since the pandemic, we are still at historically low levels. With demand remaining high, it is difficult to predict when we will see a big change.

RB: While general inventory levels have increased, top of the line, move-in ready inventory is still low and trading fast, at record prices.

4. What are top of buyer wish lists in 2023?

RW: Palatable pricing, quick access into town and bedroom count.

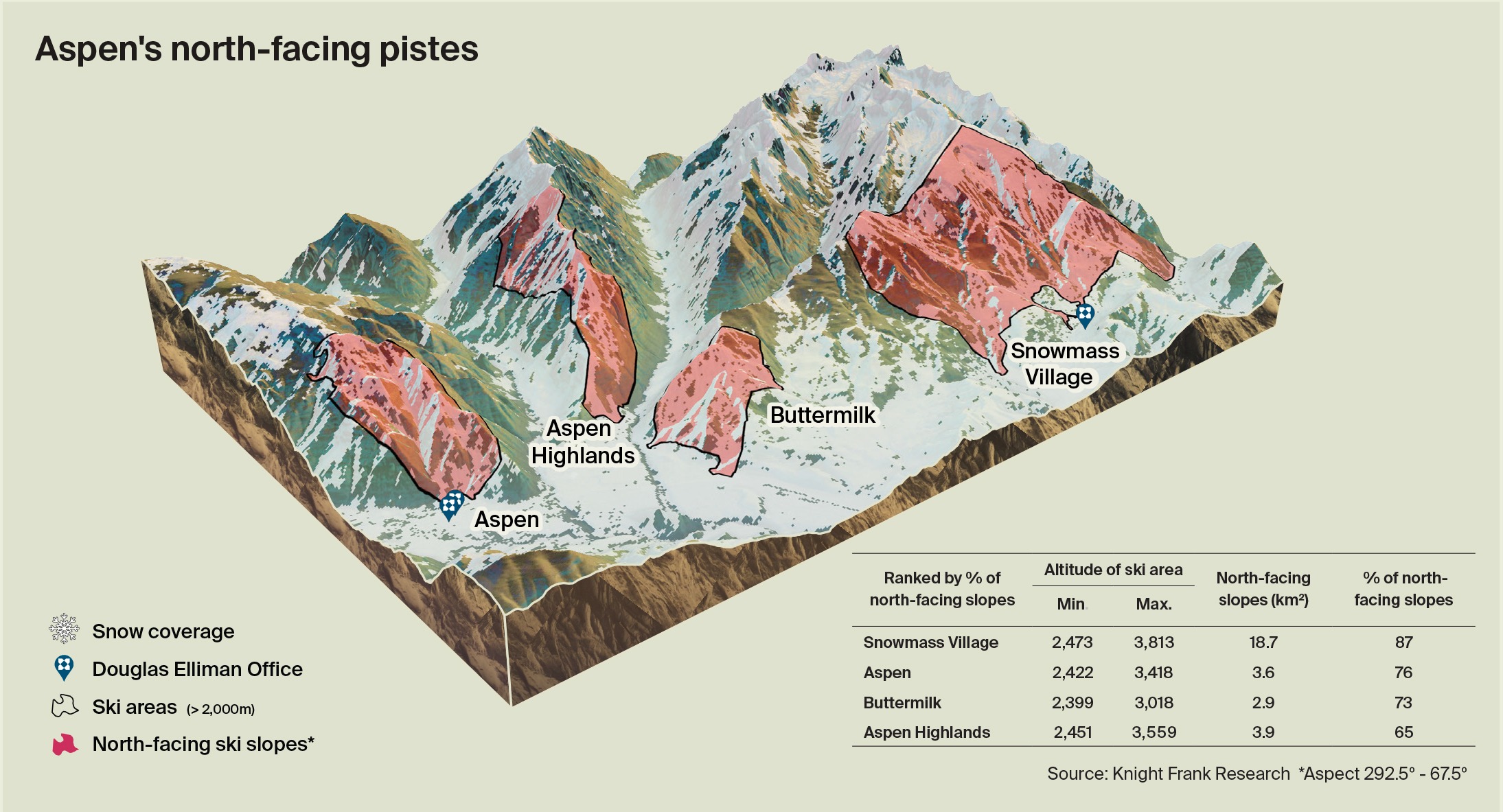

MM: Views, river location, close to town, and ski in/out properties continue to be high on wish lists.

RB: Turn-key homes of the highest quality, walking distance to town and the gondola. There is also a continued focus on low maintenance homes for many second homeowners.

5. What are the key trends that will shape the Aspen real estate market in the next five years?

RW: Pitkin County is undergoing a downzoning – reducing the density of homes. Existing homes over 9,250 sq ft will have upward pricing pressure because of this. Build costs are also steadily increasing, which will increase the value of existing, turn-key properties and potentially put downward pressure on vacant land.

MM: Climate concerns are a hot topic as our towns look to mitigate climate change by changing codes and managing new home sizes. Aspen/Snowmass is also seeing the benefits of investing in year-round leisure and entertainment.

RB: The market is no longer Aspen-centric. We’re seeing a shift from a ski-focused life and greater connectivity across the valley with Snowmass, Basalt and Carbondale.

6. Where do you see opportunities for second home purchasers and investors?

RW: Opportunity in Aspen is in buying a home that needs a little work and performing a remodel. This saves you money, time and creates a turn-key property that sells for a premium.

MM: Opportunities exist in both Aspen and Snowmass for the remodelling of older properties.

RB: Many buyers see great value and opportunity moving down the valley to enjoy the longer summer season, more golf courses and easy access to all our great outdoor activities.

Hot property:

Aspen’s Miner Cabins

Built in the 1800’s for the silver miners who, at that time, produced a sixth of the country’s silver, the one hundred or so colourful miner cabins that line streets in Downtown Aspen, have proven highly popular with buyers seeking Victorian architecture.

Snapped up by the wealthy, the miner cabins are usually around 600-1,000 sq ft in size, but large extensions are commonly approved. However, in contrast to most global planning authorities, in Aspen the design of the extensions must be in contrast to the original cabin. Prices typically start at US$8.5 million, but vary depending on the size of the extension.

Discover more

For more market insights from leading experts, the latest price trends, buyer sentiment and more, download below or visit the Ski Property Report hub.