Continued strong recovery for UK hotel market

Resilient operational trading performance with impressive year-on-year revenue and GOPPAR growth in August, despite ongoing cost pressures and normal seasonality challenges.

3 minutes to read

For further analysis, download Knight Frank’s UK Hotel Dashboard. We provide a detailed overview of key performance indicators for both London & Regional UK, summarising trends in revenues, expenses, and profitability. In this month’s edition we spotlight on the performance of Select Service Hotels for both London and Regional UK.

Key Headlines:

- Seasonal trends resulted in weaker and changing demand in August, compared to July, but with strong operational year-on-year performance, in terms of both revenue and profits.

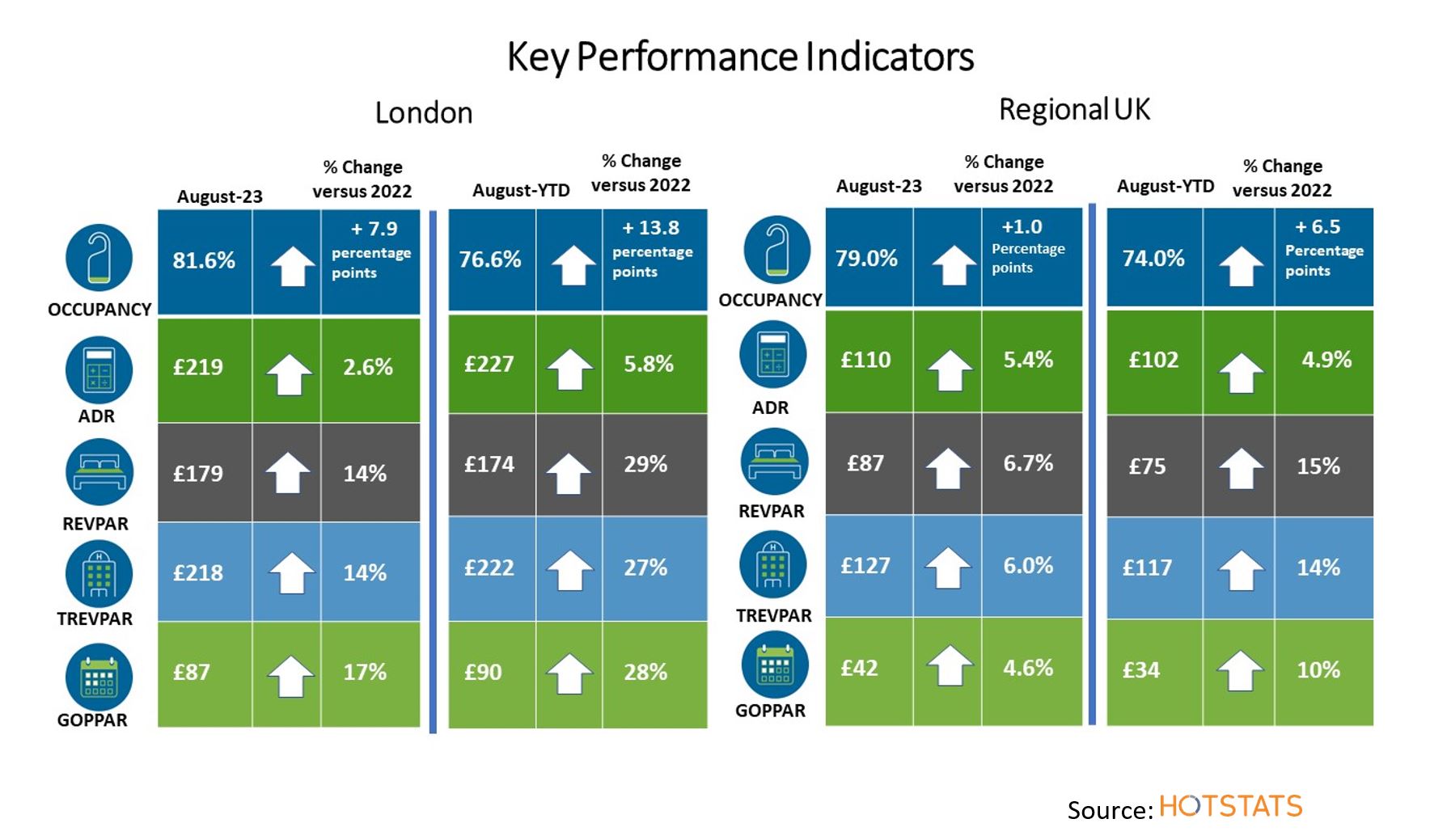

- London hotels achieved occupancy of 81.6% in August, rising by 7.9 percentage points versus August 2022, and with more moderate ADR growth of 2.6%. Hotel demand was supported by the recovery in international demand, with overseas arrivals at Heathrow Airport some 24% ahead of August 2022, but occupancy remains four percentage points below August 2019 levels.

- Improving demand has seen London’s occupancy reach almost 77% as at August YTD 2023, some 14 percentage points above August YTD-2022, whilst London’s hotel supply has seen some 1,800 new hotel rooms open since the start of the year.

- Utility costs increased by 40% PAR in London as at August YTD versus the same period in 2022, but with costs rising by just 15% POR. Whilst higher occupancy is driving higher consumption, the data is also impacted by fixed price contracts ending, making meaningful analysis difficult.

- London recorded strong GOPPAR growth for the month of August, up 17% versus August 2022. For the August-YTD period, GOPPAR of £90 was recorded, an uplift of 28% versus YTD-2022 and is now ahead of its YTD-2019 performance by 2.8%.

- London’s Select Service Hotels outperformed the wider London market in terms of occupancy, reaching 84% in August, but still lags its pre-pandemic performance. Transient rooms revenue account for 93% of the revenue mix, year-on-year transient room rates have increased by 9.6% YTD-2023 and are 28% ahead of YTD-2019. RevPAR is up 24% versus YTD-2019. The strong top-line performance has seen a strong uplift in GOPPAR, up by 33% as at August YTD versus 2022 and 9% ahead of YTD 2019. Profit margins though remain challenged, significantly lower at 47% YTD-2023, compared to 53% YTD-2019.

- Regional UK delivered an impressive month of trading results with a monthly uplift in ADR of 5.4%, the main driver behind year-on-year RevPAR growth of 6.7%. In real terms ADR was 4.1% ahead versus August 2019.

- As at August YTD, Regional UK has seen RevPAR growth 20% ahead of its YTD-2019 performance, boosting income generated from the rooms department by 19% over the same period. Trading, however, has been far more challenged in the Food & Beverage department, with F&B departmental income declining by 18% over the same period.

- Total payroll costs across Regional UK were 14% higher as at August-YTD versus August 2022. Meanwhile, utility costs increased by 27% PAR year-on-year over the same period.

- Despite cost pressures, GOPPAR in August across Regional UK increased on average by 4.6% year-on-year, whilst monthly profits were 20% ahead of August 2019. As at August-YTD GOPPAR at £34 is up by around 10% versus YTD-2022 and YTD-2019.

- Regional UK’s Select Service Hotels are outperforming all regional UK hotel segments, with GOPPAR surging ahead of its YTD-2022 performance by 25% and is 31% ahead of YTD-2019. A challenging cost environment remains, but strong revenue growth, with RevPAR up by 27% versus YTD-19, is fuelling the strong growth in GOPPAR. The YTD profit margin of 35% remains on par with 2019.

Download the latest hotels dashboard here

UK Hotels Trading Performance Review - 2022

The market leading report provides detailed insight into the operational revenues, costs, profitability and KPIs of the UK hotel sector, during a sustained period of challenging market conditions, with accelerating costs and a reduction in profit margins.

Download now