Green shoots in June's inflation figures

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

UK inflation climbed less than economists expected during the year to June, the first time in months that rising prices have come in the right side of consensus.

The Consumer Prices Index eased to 7.9%, down from 8.7% last month and below expectations of an 8.2% rise. Core inflation eased to 6.9%, down from 7.1% last month and below expectations of a hold at 7.1%.

These are by no means good numbers - it's a long way down to the 2% target from here - but this hopefully marks the end of a run of bad numbers that each marked a new multi-decade high. It'll certainly improve sentiment and should bring interest rate expectations down. Swap rates have already eased a little from recent highs and it's possible that we see mortgage rates steady during the coming days.

Pipe dreams

The UK's plan to cut emissions from the stock of existing homes is still a work in progress.

For years, there has been uncertainty over whether the gas network can be repurposed for hydrogen, whether homeowners can be convinced to install huge numbers of expensive heat pumps, or how a mix of the two options might work.

The government appears to be going cold on hydrogen. Grant Shapps, the Energy Security Secretary, told an event in Westminster last week that hydrogen would be more suited to heavy industry and transport than for domestic heating. He stopped short of suggesting that hydrogen wouldn't play any part, but he did say that the time it takes to replace infrastructure and produce green hydrogen "would mean the transition would be very slow."

This comes after a trial of hydrogen heating systems in a town near Liverpool was scrapped after the community pushed back in favour of gas boilers and heat pumps. Political opposition to hydrogen appears to be growing, too.

Mixed messages

Hydrogen might well prove to be unsuitable. If that's the case, the government will likely need to provide very large subsidies for heat pumps, both to industry to scale up production and train up installers, and to sceptical homeowners who so far have shown little interest.

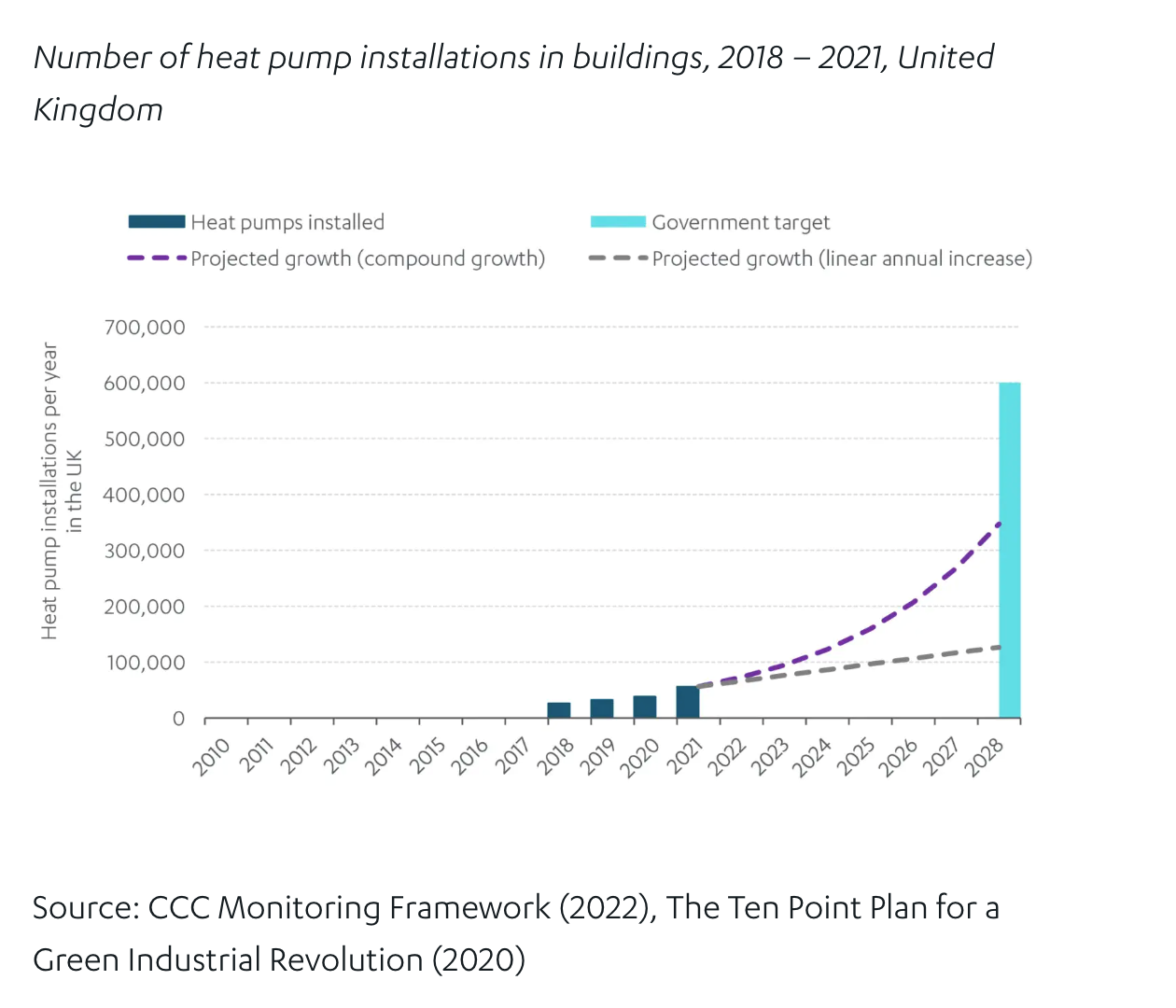

The government isn't short on ambition. It's targeting 600,000 installations a year by 2028, up from just 55,000 installations in 2021. But even if the market were to grow by a blockbuster 30% every year, the 600,000 target still wouldn't be met, the National Infrastructure Commission said earlier this year (see chart).

The lack of suitable incentives must be resolved eventually, but the more immediate problem is the mixed messages that the government gives to industry.

“Boiler manufacturers who were told to develop hydrogen-ready boilers by the Government will now rightly ask - why bother?”, Mike Foster, chief executive of the Energy and Utilities Alliance, told the Telegraph. Similar sentiments have been issued by heat pump manufacturers - nobody wants to commit the investment required while the government is so fickle. I wrote a more detailed take on these policy gaps in March.

Warehouses ESG

All new existing leases for commercial properties in England and Wales must meet at least an Energy Performance Certificate (EPC) grade B by 2030, under government proposals. Whatever you think of these Minimum Energy Efficiency Standards (MEES), they at least provide a clear message to property owners relative to the confusion prevailing in the residential sector.

Claire Williams has published a new report that outlines the challenges faced by the industrial and logistics sector. Around 404 million sq ft of warehouse space currently falls short of the proposed grade EPC B requirement.

For all buildings to reach the target, the progress rate must be at least 10% of stock per annum (units over 50,000 sq ft). Our analysis shows that the current rate falls short at just 6%, but there are significant regional variations.

The East Midlands is a highly tenanted market and is leading the way on energy performance. Despite this, the historical progress rate for the region stands at only 6% per annum, indicating that if this trajectory continues, the remaining warehouse stock will not achieve a minimum EPC B grade until 2031. The West Midlands, South East, London, and South West regions are progressing notably slower. Based on current trends, it would take until 2057, 2047, 2047, and 2044, respectively, for these regions to upgrade their entire existing building stock to the minimum EPC grade B.

See the report, linked above, for more.

In other news...

Mallorca’s property market is in top gear, welcoming over 200,000 cyclists each year with many looking to rent or buy property in Spain. Kate Everett-Allen has more.

Elsewhere - Wall Street banks ditch bullish dollar bets over ‘soft landing’ hopes (FT).