Why the lenders can ride out the property downturn

Making sense of the latest trends in property and economics from around the globe.

6 minutes to read

The surge in UK mortgage rates that began in mid-May knocked industry sentiment to lows not seen since the weeks following the mini-budget, according to a RICS survey of estate agents taken through June and published this week.

The net balance of new buyer enquiries, where a reading below zero signals a contraction, fell to -45% in June, down from a reading of -20% last month. That's an eight month low. The metric of newly agreed sales dropped to -34%, from -8% last month. That's the lowest since December. A net balance of -31% of survey participants foresee sales declining over the twelve-month time horizon, bringing to an end a three-month run of largely stable sales expectations for the year ahead.

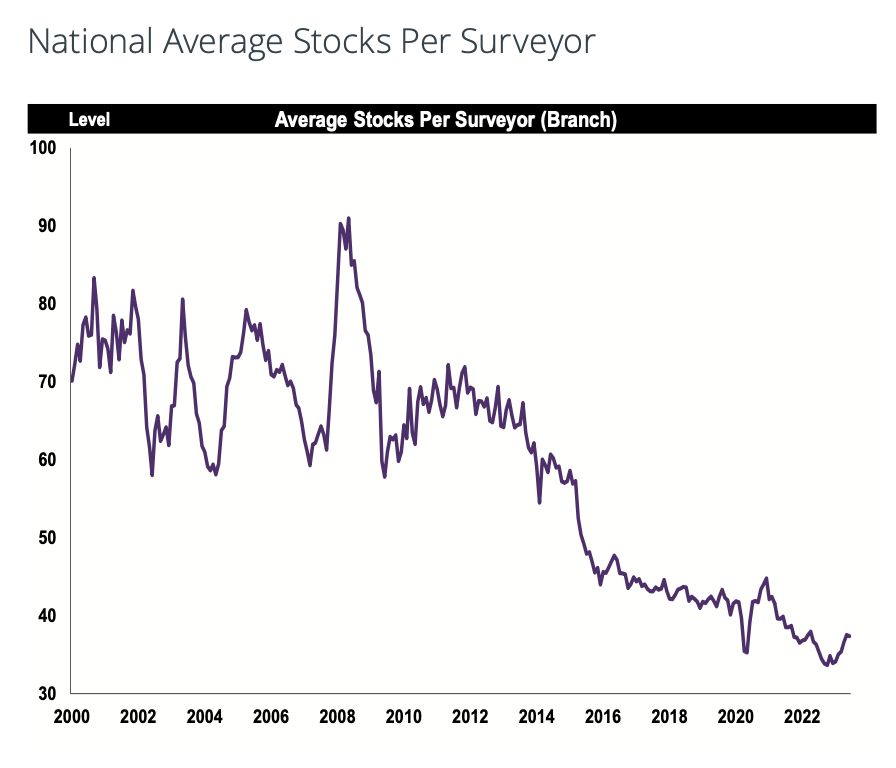

Having picked up slightly during May, new sales instructions held more or less steady in June. Though the current level of inventory is slightly higher than that reported at the end of last year, the average number of homes available for purchase remains very low relative to long run averages (see chart). Depleted levels of stock will persist, which we think will be a significant factor limiting national price falls to about 10% during the next two years.

The mortgage squeeze

The Bank of England's biannual Financial Stability Report, also out this week, puts some numbers on the challenges faced by homeowners remortgaging during the next few years.

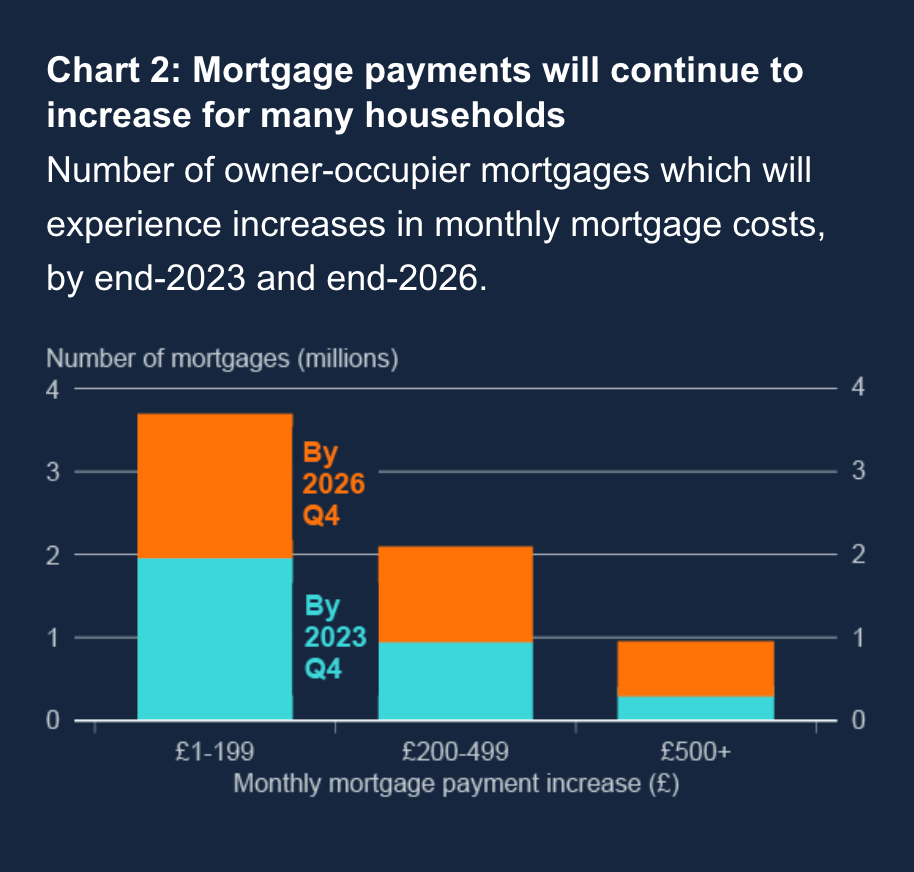

Nearly a million households will face an increase in monthly payments of at least £500 by Q4 2026 (see the first chart below). Two million will face an increase of £200 - £499. Almost four million will be paying up to an extra £199. The increase in mortgage interest payments could prompt landlords to sell, which could put downward pressure on house prices, though they may seek to pass higher costs onto renters instead (more on this shortly).

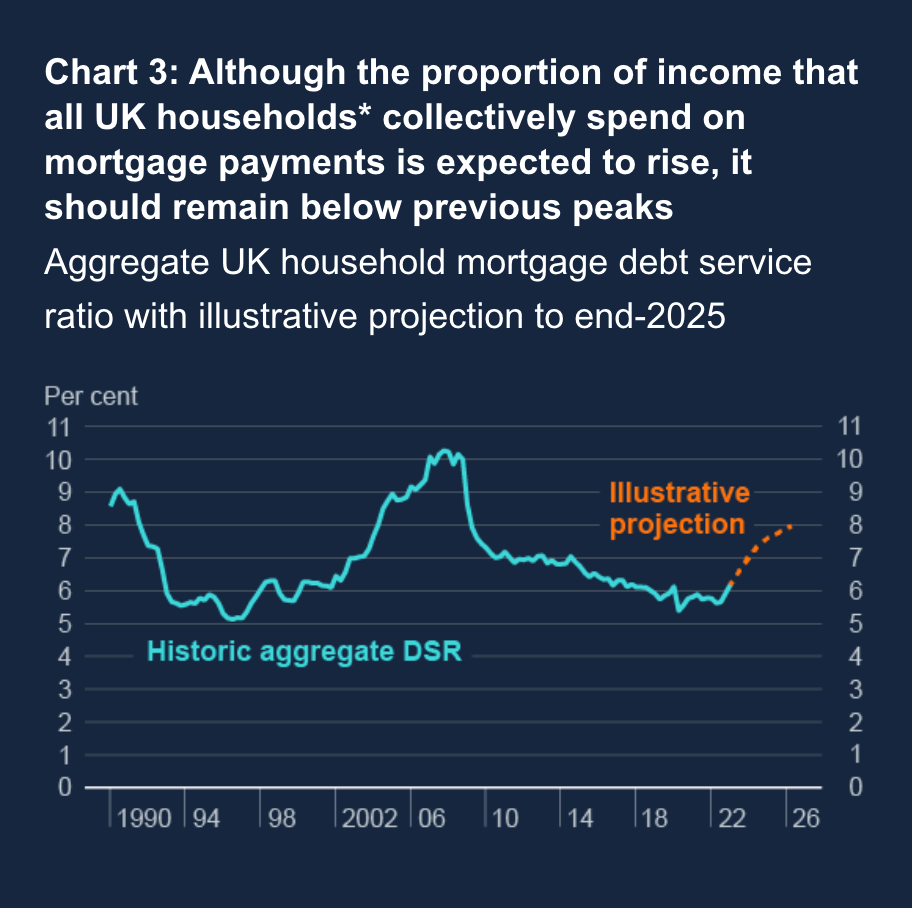

While this is serious for those affected, the proportion of income that UK households spend on mortgage payments will remain below the peaks experienced in the Global Financial Crisis and in the early 1990s (see second chart). The lenders, meanwhile, are "in a strong position" to support customers who are facing payment difficulties, which will mean lower defaults than previous crises. Lending regulations introduced since the GFC have also helped limit the build-up of risk in the mortgage market.

CRE exposure

The Bank notes the various headwinds faced by commercial real estate (CRE) markets, namely higher interest rates weighing on values, the impact of remote work on office vacancy rates, the effects of online shopping on retail property values, and the costs of upgrading buildings to meet stricter energy efficiency standards.

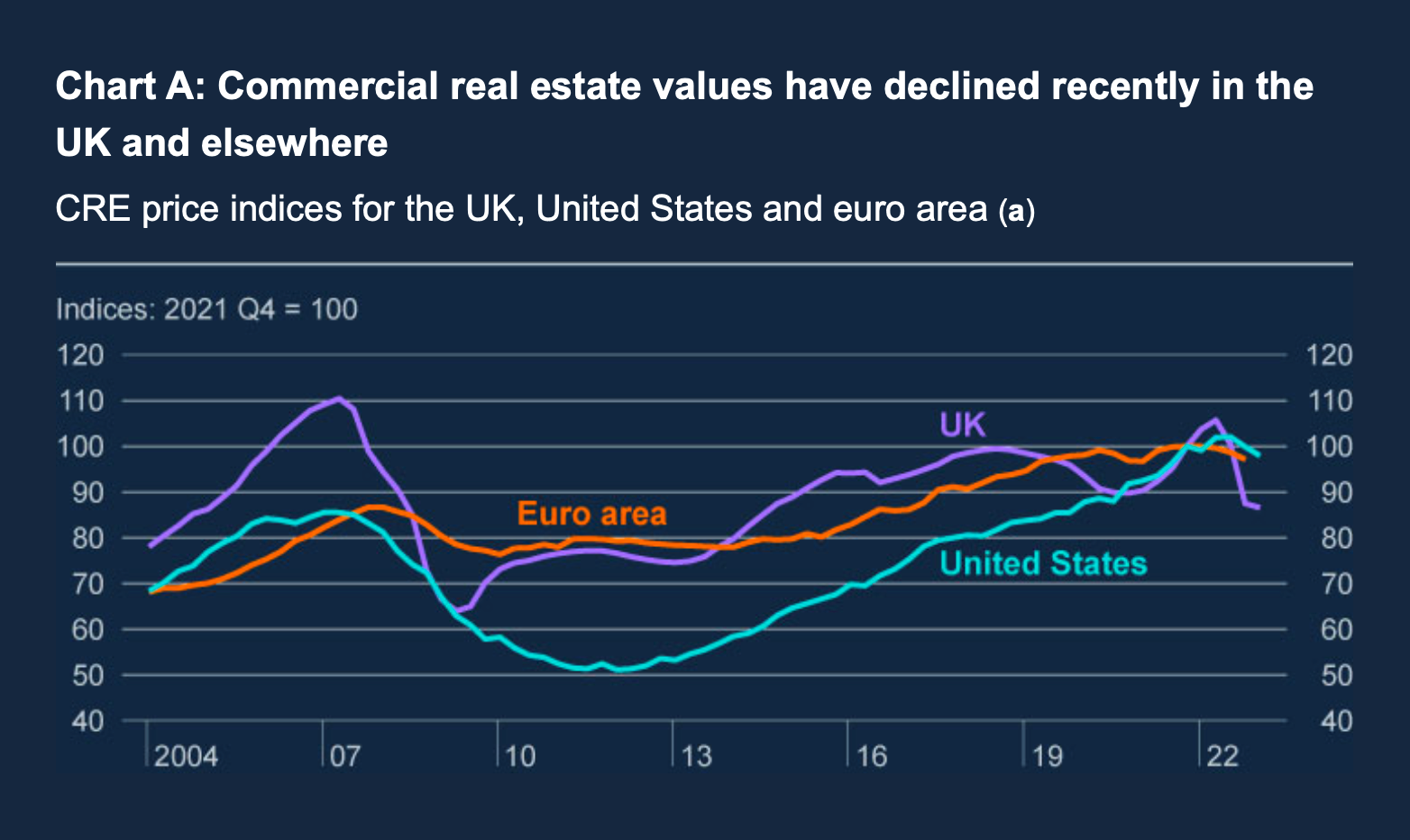

UK CRE prices have so far fallen about 20% from their mid-2022 peak - sharper than declines seen in the US or Eurozone, though historically the UK market has tended to react more quickly than elsewhere, the Bank said (see first chart).

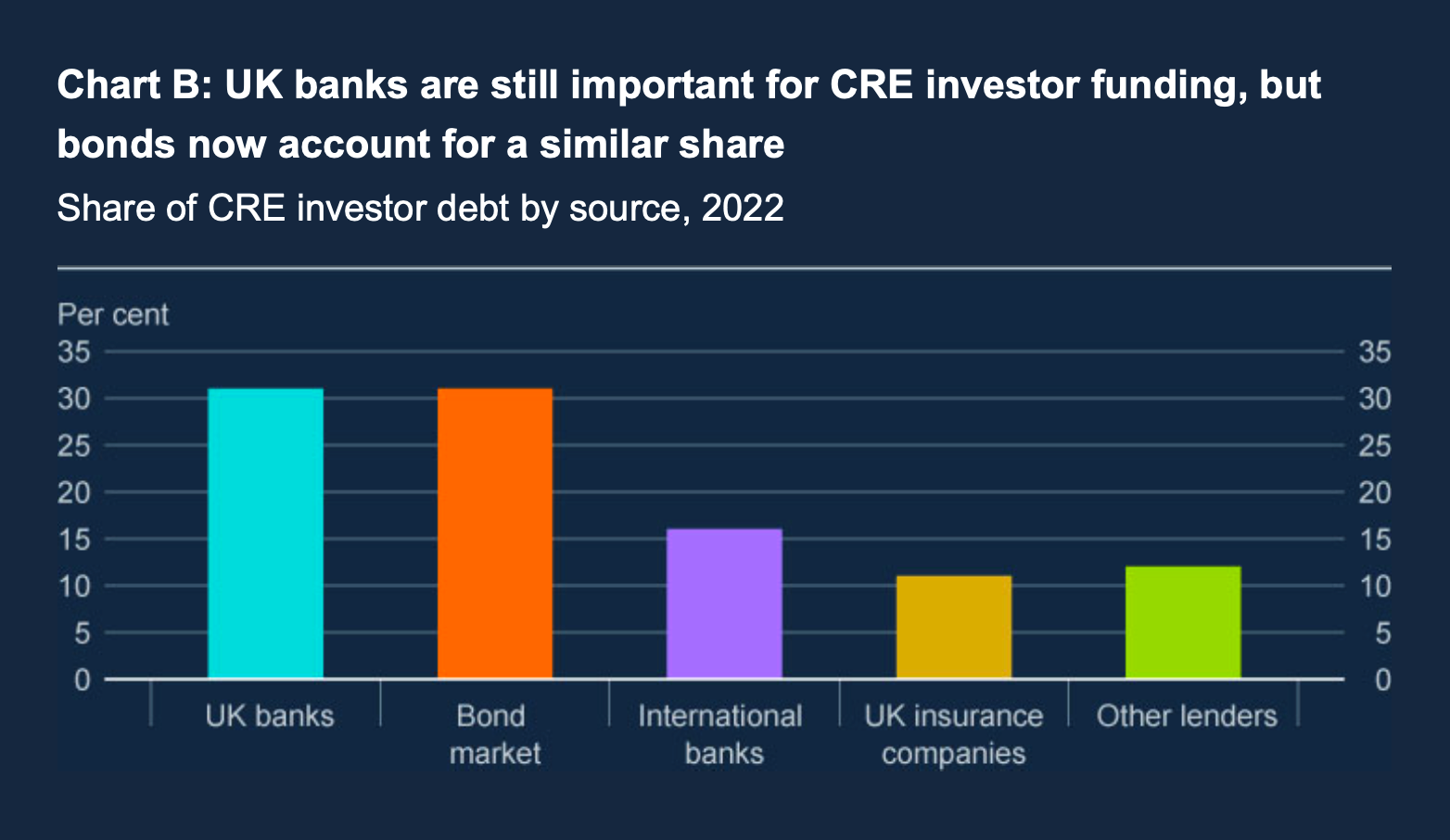

Still, the banks are resilient in their exposure to the sector, in part due to a structural shift in funding sources (see second chart). The banks’ share of outstanding CRE debt has declined from over 60% in 2008 to just over 30% now. Over the same period, the aggregate loan to value (LTV) ratio of major UK banks’ CRE lending has improved and almost all of it is currently below 75% LTV.

Investors are now more reliant on market-based finance and international banks, though this funding mix has yet to be tested in a severe CRE downturn. Foreign investors, meanwhile, might be more likely to react sharply to a market stress and retrench, which could amplify risks posed to leveraged investors and open-ended funds. However, the majority of UK CRE investors, including institutional investors, have long-term investment horizons and are generally diversified.

Overall, the stress test suggests "that the UK banking system would continue to be resilient, and be able to support households and businesses, even if economic conditions turned out to be much worse than we expect," the Bank concluded.

The outlook for renters

The RICS survey and the various Bank of England remarks point to an economic downturn that will be felt unevenly. The outlook for renters, for example, looks particularly tough.

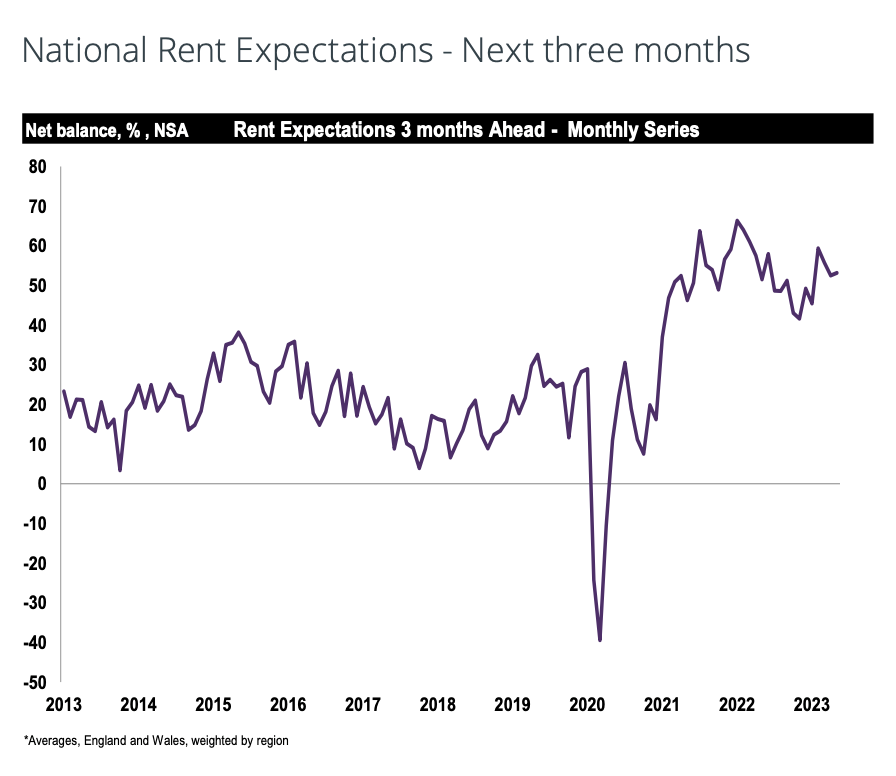

Worsening affordability in the sales market is fuelling rental demand as supply contracts. A net balance +40% of RICS respondents saw an increase in tenant demand during June. At the same time, the net balance for landlord instructions sunk to -36%, the most negative reading since May 2020. As a result, a net balance of +53% of contributors anticipate rental prices being driven higher over the near-term (see chart).

Data from TwentyCi shared with the FT shows the number of homes available to rent nationwide at a 14-year low. There were 241,000 available homes to rent in June, down from 370,000 in June 2019, an eye-watering decline of 35%.

This is clearly unsustainable and there are few, if any, short term fixes. Developers of all tenures are understandably cautious while the outlook for borrowing costs remains so uncertain, but the eventual revival of construction activity must be supported by effective policy if it is to match the growth in population. That must include nurturing the build to rent sector, which will play an increasingly important part of urban housing supply during the decade to come. I'll share more on this in an Evening Standard column shortly.

Mixed use planning

"Attempts to reform the planning system have so far taken the wrong starting point. Too much time and energy has been spent on making housebuilding more palatable to people living in leafy and out of town areas rather than mixed-use development in urban areas."

Those are the views of Mark Allan and Simon Carter, the respective CEOs of Landsec and British Land, writing in the Telegraph this week. Focusing on urban areas would deliver more growth, more homes and more jobs, they say. The piece cites data from Oxford University professor Ben Ansell, which shows that there are just 55 parliamentary constituencies in the UK which demonstrate net public support for house building in their local areas, all of which are overwhelmingly urban in nature.

Suggestions to improve the system include:

- Creating a new definition for “brownfield urban regeneration”. That would mean explicitly encouraging development on brownfield urban regeneration in national policy rather than simply focusing on “previously developed land”.

- An enhanced funding settlement for local governments to improve resourcing in planning departments.

- Incentivising in the planning system "an exemplary and inclusive approach to community engagement".

In other news...

US inflation slows to 3% (CNN), but a top Fed official still wants two more hikes (FT), England's falling job ads ring a recession alarm (Bloomberg), the world has the hottest June on record (Bloomberg), Britain’s life sciences losing foreign backers (Times), and finally, UK's ageing population means taxes must rise even further, warns OBR (Telegraph).