Specialist hotel owners, HNWIs and family offices lead hotel H1-2023 investment

Despite tightening monetary policy, investment levels have remained robust.

5 minutes to read

As we enter the second half of 2023, the gulf between hotel trading performance and transactional activity has never been wider.

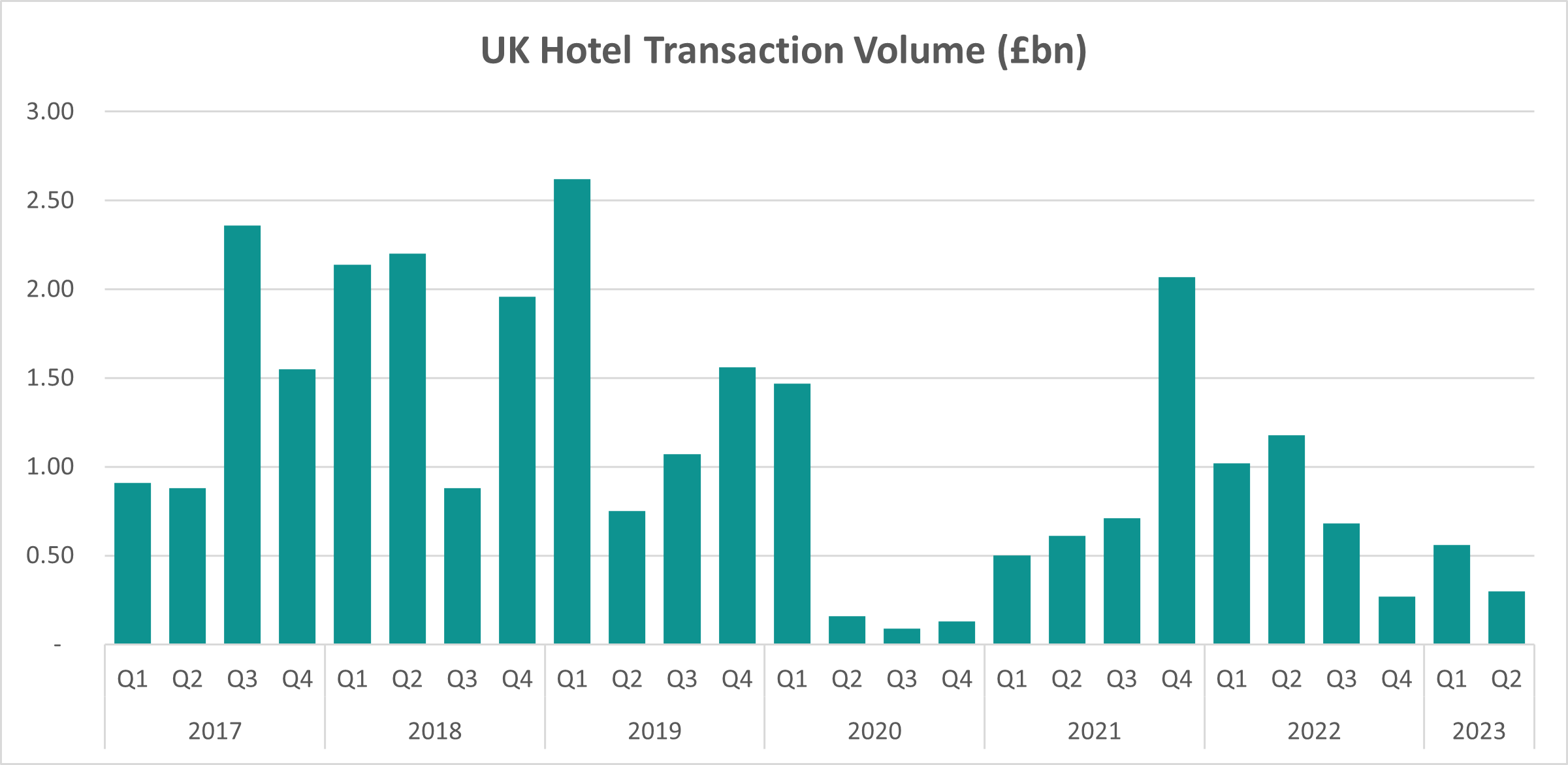

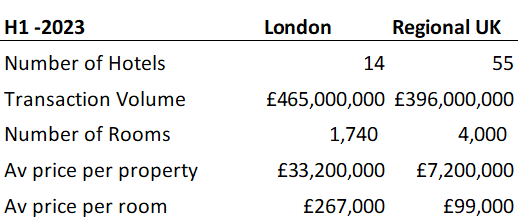

With hotel transaction volumes at around £860 million for the first six months of 2023, some 60% below investment volumes for H1-2022, and Q2-2023 investment volumes slightly ahead of Q4-2022, this reinforces just how challenging it is to successfully execute and complete a deal.

Hotel trading performance

Meanwhile, the recovery of UK hotels’ trading performance has so far been remarkable, given the extensive headwinds endured.

Data company HotStats benchmarking data reports London’s RevPAR performance 50% higher for the first five months of 2023 versus May Year-to-date (YTD) 2022, and YTD GOPPAR equalling its pre-pandemic performance.

In Regional UK, YTD RevPAR is 20% higher than compared to May-YTD 2022 and with YTD GOPPAR trailing its 2019 performance by 1.5%.

Source: Knight Frank Research

Historically, there is always a close correlation between investment volumes and GDP growth, and 2023 is no exception as seen by the sharp contraction of investment volumes.

Yet deals are completing, and those buyers most active during the past six-months have largely been investors with a deep understanding of the sector. With London’s ADR tracking above inflation and Regional UK on par with 2019 prices, this resilience in trading performance is attracting investor sentiment in the sector. Appetite to secure quality hotels in prime locations, or for those hotels with repositioning and value-add potential, remains strong.

Specialist hotel investors

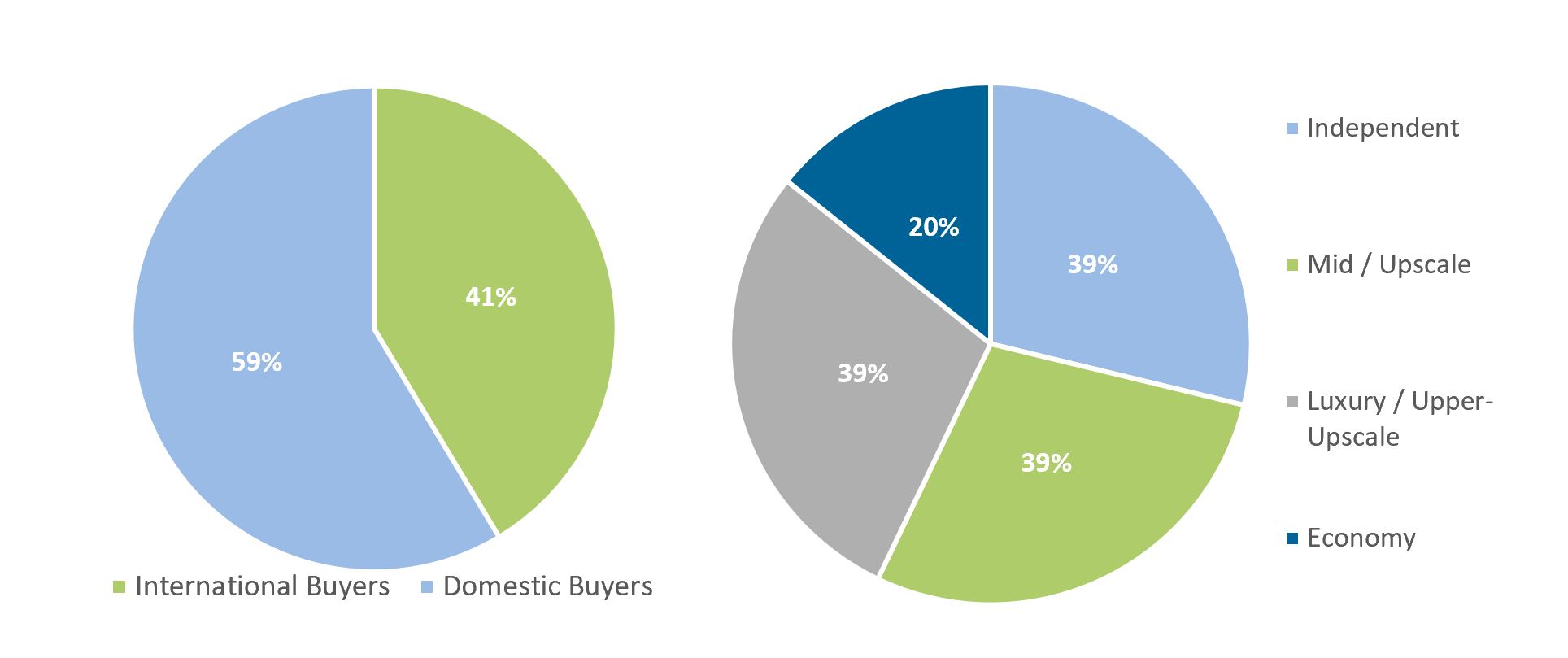

During the first half of 2023, specialist hotel-focused investors, both domestic and from overseas, as well as High-net-worth-individuals (HNWIs) and family-offices have accounted for 70% of the transaction volume. Well capitalised and non-reliant on sourcing funding through the debt markets, these buyers have continued to source quality, sizeable assets and create sustainable growth opportunities for their existing portfolios.

Mostly off-market, these deals have totalled approximately £600 million and seen an average transaction price of £273,000 per room, some 75% higher than the UK average.

International capital

Despite sterling strengthening during the last quarter, the exchange rate remains relatively low in historical terms and competitive against other overseas currencies. As such, overseas investors continue to look favourably towards the UK hotel sector, actively seeking out opportunities and were responsible for 41% of the transaction volume during the first half of the year.

Much of this investment has originated from Europe, Middle East and Asia, where access to capital has potentially been more readily available, with interest rates often lower than compared to the UK.

Private equity investors mostly absent during the first half of 2023, are set to re-emerge once the economic outlook becomes more certain and the cost of debt and financing shifts downwards. The recently completed sale of the Waldorf Astoria Edinburgh early in Q3-2023, highlights the ongoing intent for investment by Private Equity investors, but with increasingly discerning asset selection.

Barkston & Courtfield Gardens, Earls Court, London - sold to Cerberus Capital Management

Institutional investors

Meanwhile, in terms of institutional investment, more capital has exited the sector than was invested. Whilst the large insurance and pension funds continue to be heavily invested in the sector, their investment has stagnated.

The upward movement in gilts, the uncertainty regarding interest rates, compliance to meet new fire and safety regulations, as well as ESG criteria becoming far more rigorous, makes the asset selection for institutional-grade stock far more restrictive.

Where institutional capital has been deployed, this has been largely restricted to new entrants seeking to diversify their portfolios and increase their exposure in the hotel sector.

Where fixed-income, budget hotels stock has transacted, these transactions have almost exclusively been from cash buyers, motivated by their long-income, and hold some knowledge or attachment to the local market.

These buyers have been a combination of private buyers, family offices and leading hotel owners and operators. Whitbread, Dalata Hotel Group and Staycity Aparthotels, all renowned operators, utilise their strong balance sheets to finance these strategic acquisitions, most often for development sites or newly built assets, and in doing so, position themselves to gain competitive advantage for the future.

Future hotel investment

With the glass half-full, the next six months should see more robust levels of investment activity, with several hotel deals known to be under offer. The level of activity though will depend on how much further tightening of monetary policy is required in the short-term.

Interest rates will remain high over the medium term, as such, with no quick solutions to servicing the debt, lenders will be exerting greater pressure on their borrowers to calibrate debt covenants. Where additional equity is not forthcoming, selective asset sales are likely to increase, to lower gearing across portfolios.

H1 hotel investment highlights

Source: Knight Frank Research

Philippa Goldstein, Senior Analyst – Hotels & Leisure at Knight Frank, comments: “With the continued rise of interest rates, this has created upward pressure on yield requirements, but with greater resistance than compared to other property sectors. Hotel room rates, particularly in London, are keeping pace with inflation and with robust levels of trading, where cashflows have increased, this is helping to limit the negative effect on value.”

Henry Jackson, Head of Hotel Agency, and Partner at Knight Frank, adds: “Movement in pricing provides opportunity for buyer and seller price expectations to be realigned and further incentivises other types of investors to enter the market. HNWI and family offices are certainly becoming more active in the sector and with the increasing cost of debt finance they can outbid other types of buyers. Where assets have been operating exceptionally well, we are seeing competitively priced assets attract multiple strong offers, proof that capital is readily available where investors can see value.”