Are investors wrong on UK interest rates?

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

Mortgages

Average fixed rates on two-year mortgages hit 6.66% yesterday, surpassing the highs reached during the fortnight following last autumn's mini-budget, Moneyfacts said yesterday.

This probably has further to run. Some pretty hot wage inflation figures published yesterday provided a little extra topspin (more on this shortly). Sterling hit a 15-month high against the dollar. Markets priced a 74% chance of a 50 basis point rise in the base rate at next month's Bank of England meeting, up from 66% before the publication of the pay data.

Uncertainty over how high rates will peak and how long the peak will last has had a dramatic impact on borrowers in recent weeks. Up until early May, large numbers of homeowners were putting off remortgaging, taking the view that rates were set to fall. The surge in mortgage rates that began in mid-May put an end to those hopes and coaxed large numbers into acting. The value of new remortgages written by Knight Frank Finance jumped 41% over May and June compared with the previous two-month period.

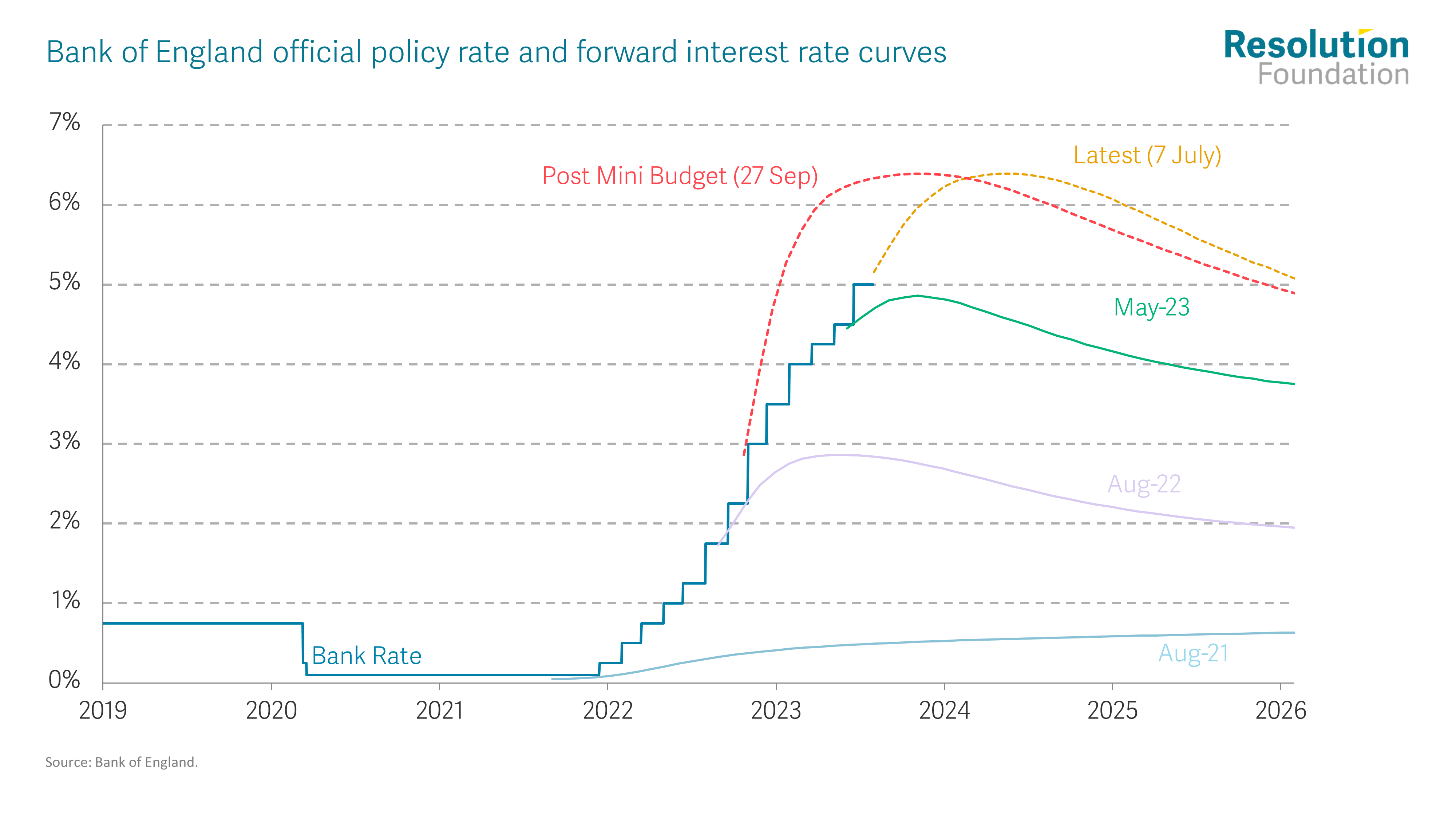

The chart below from the Resolution Foundation encapsulates why so many borrowers decided that now is the time to act. Markets no longer expect the base rate to ease back to 5%, where it stands today, until 2026. We think these figures warrant some scepticism - I talked last week about the "self-feeding" dynamic in play here as traders exit positions before unpredictable conditions move against them.

Slack

Average pay excluding bonuses rose by 7.3% in the three months to May, the joint fastest pace on record, the ONS said yesterday.

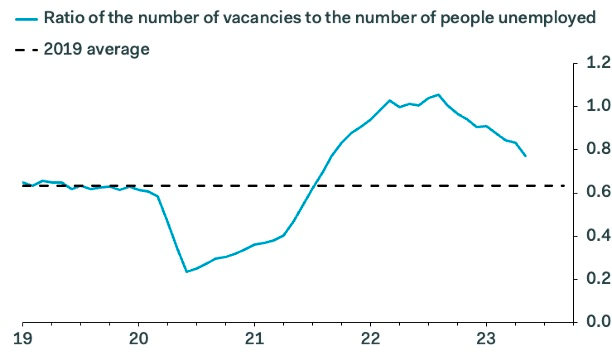

So far, so bad, but beyond the headline reading there were plenty of signs that the labour market is loosening - see this useful thread from Samuel Tombs of Pantheon Macroeconomics. The single-month unemployment rate rose sharply. Job vacancies fell at the fastest rate since 2009. The vacancies-to-unemployment ratio—"now the MPC’s go-to measure of labour market tightness"—fell to 0.77 in May, from 0.83 in April (see chart). That metric will reach 2019’s average level by November if the current rate of decline is maintained.

These signs of loosening will soon start weighing on wage growth and, while it looks like rates will stay higher for longer, it's difficult to see how the base rate would need to be at today's level three years from now, as the forward interest rate curves suggest.

"Wage growth still has far too much momentum, but we know it lags trends in labour market slack," Tombs concludes. "The clear message from the slack indicators is that the MPC needn’t hike Bank Rate as aggressively as markets now are pricing in."

The flight to quality

London's office landlords let 3.9 million square feet of space in the first half of the year, down from 5.8 million square feet during the same period a year earlier, according to Knight Frank figures shared with the Evening Standard yesterday.

The uncertain outlook is impacting corporate decision making, but those that are taking space are competing for ultra-modern or newly refurbished buildings. New or newly refurbished space accounted for 60% of take up during the period, up from 57% during H1 last year and just 39% during the same period in 2019.

"Businesses are typically favouring buildings that offer flexible floorplates, terraces, cafes and wellness amenities as well as excellent sustainability credentials to support their ESG goals," says Knight Frank's Head of London Research Shabab Qadar "Moving forward we will see more refurbishment activity as property owners reposition older space to meet modern occupier needs.”

British Land highlighted similar themes in a trading update yesterday. Occupancy at the company's campuses stood at 96%, with 164,000 sq ft of leasing completed in the first quarter, 11.4% ahead of ERV and a further 102,000 sq ft under offer, 5.7% ahead of ERV. "We have c.1m sq ft in negotiations and have seen a noticeable uptick in viewings in the last few months as demand continues to gravitate to best in class space," the company added.

Back on the shopping list

"Retail parks continue to be the winning retail format given their affordability, omni-channel compatibility and low capex requirements," British Land CEO Simon Carter said yesterday. Occupancy stands at 99%. Footfall is up 1% YOY and sales are up 6% YOY.

The retail sector is enjoying a turnaround, with improving investment demand and increasing liquidity, Knight Frank's Stephen Springham reported in his update last week. Rents and values appear to have turned a corner and the buyer pool is growing. Retail was the best performing of the traditional commercial sectors in the first half, according to MSCI's total return figures, which had retail at +2.90%, offices at -2.40%, industrial at +2.50% and all property at +1.40%.

Retail’s strong MSCI H1 2023 performance was driven by the buoyant Retail Warehousing market. Total returns for Jan-May 2023 were +4.10%. Evidence of rebased rents, reduced rates liability and low void rates has sparked an increase in institutional activity within the sub-sector, with UK institutions now serving as the principal buyers and accounting for 52% of acquisitions during the period.

Until recently, Shopping Centre investment liquidity has been confined to smaller lot size sales. This year, we have seen a step change with a handful of bigger ticket transactions taking place. Notable activity includes Landsec’s off-market acquisition of the remaining 50% in St David’s, Cardiff. You can read more from Stephen here.

In other news...

In a new Rural Market Update, Mark Topliff mulls Nestlé's decision to move away from using carbon offsetting to focus on reducing emissions in its value chain and operations.

Elsewhere - can the UK actually do “growth” - Whitby ‘hydrogen village’ rejected after opposition from residents (Times), UK firms most upbeat in 10 months despite economic headwinds (Reuters), London and South East gain half of net growth in jobs since 2010 (FT), US inflation forecast to hit lowest level in more than two years in June (FT), Singapore's surging rents to be a big election issue, survey shows (Bloomberg), and finally, Hong Kong relaxes mortgage rules (Bloomberg).