Improving revenue growth for Regional UK’s top-12 city centre hotel markets

The strong top-line performance of the top 12 regional cities recorded a monthly uplift in GOPPAR of 12% in April, and for the first time in 2023 GOPPAR was higher than the regional UK average.

3 minutes to read

For further analysis, download Knight Frank’s UK Hotel Dashboard. We provide a detailed overview of key performance indicators for both London & Regional UK, summarising trends in revenues, expenses, and profitability. In this month’s edition we spotlight on the UK Serviced Apartment sector.

Key Headlines:

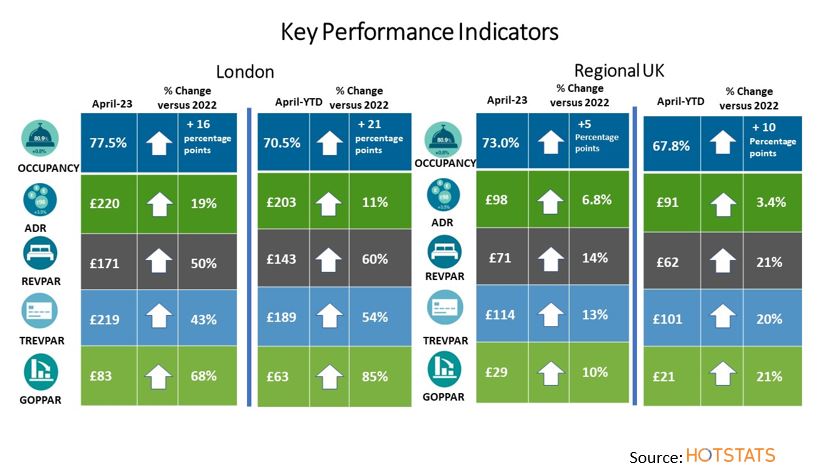

- Regional UK achieved 73% occupancy in April, a month-on-month increase of 1.9 percentage points and a 4.7 percentage point increase versus April-2022. ADR increased by 5% in April versus the previous month, to achieve a monthly uplift in RevPAR of 8% and a 14% increase versus April-22.

- Fuelled by a three percentage-point monthly growth in occupancy to 75% and ADR growth of more than 10% in April, the top-12 cities achieved RevPAR some 15% higher than in March and 20% above the regional UK average.

- With overseas arrivals at Heathrow rising month-on-month by 3.5% in April, London witnessed a robust uplift in occupancy versus the previous year, a rise of 16 percentage points - albeit this was at a time when the recovery post Omicron had just begun. London’s occupancy still lags its pre-pandemic performance, at 1.8 percentage points below April-19, but with the outlook positive for the months ahead.

- In April, London experienced RevPAR growth of 12% over March 2023, whilst TRevPAR growth was lower at 7%, impacted by conference F&B revenue PAR remaining 20% lower than in April 2019.

- The data shows YTD ADR growth of 11% in London and 3.4% in regional UK, indicating that hoteliers in London are currently tracking inflation better than regional UK. In the coming months, if inflation falls in line with forecasts and demand strengthens, London is likely to see REAL ADR growth versus 2019, whilst regional UK is likely to see REAL ADR on par or fall slightly below 2019 levels.

- Utility costs increased by 39% in London and by 28% across regional UK in the 12 months to April. Going against the trend of reducing costs each month since January-23, April recorded a rise in utility costs of 5% across regional UK and 1% in London. Utility costs in April averaged 8.2% of total revenue across regional UK, whilst in London with revenues strengthening, utility costs fell below 5% of total revenue for the first time in 2023.

- In line with the 9.7% rise to the National Living Wage in April, total payroll costs for the month of April increased on average by 9% across London and regional UK hotels, versus March-23, to £62 PAR in London and £37 PAR across regional UK. A more severe increase was recorded in the top-12 regional cities, with total payroll costs rising by 11% PAR, indicating that hiring and retaining staff in these cities is proving more challenging.

- As at April YTD, London’s GOP increased by 85% versus the same period in 2022 to £63 PAR, and GOPPAR growth of 7.5% versus the previous month.

- Regional UK achieved more modest GOPPAR growth, up 21% on April YTD-22 to £21 PAR, but with ongoing cost pressures recorded monthly GOPPAR 2.4% lower than in March. By contrast, the strong top-line performance of the top 12 regional cities recorded a monthly uplift in GOPPAR of 12%, and for the first time in 2023 GOPPAR was higher than the regional UK average.

Download the latest hotels dashboard

UK Hotels Trading Performance Review - 2022

The market leading report provides detailed insight into the operational revenues, costs, profitability and KPIs of the UK hotel sector, during a sustained period of challenging market conditions, with accelerating costs and a reduction in profit margins.

Download now