UK Industrial and Logistics: Q1 data shows resilient sector

Analysis of Q1 data shows growing diversity of occupier base, demonstrating resilience of sector despite temporary pullback in online retailer demand.

3 minutes to read

Breadth of occupier demand

Last year manufacturers accounted for a quarter of all take up and this has continued into 2023, with manufacturing firms representing 26% of all floorspace taken in the first quarter, this compares with 19% in 2021 and just 10% in 2020.

Demand from advanced manufacturers, including engineering, electronics, and automotive and aerospace firms, accounted for just over 10% of annual take up between Q1 2022 and Q1 2023.

Meanwhile, occupier take up from life sciences manufacturers rose 193% in the past 12 months, with Siemens Healthineers taking just over 600,000 sq ft in Bicester, Pelican Healthcare taking 82,000 sq ft in Cardiff, and CMR Surgical taking 75,000 sq ft in Ely, near Cambridge all in the first quarter this year.

Inflationary pressures persist

Inflation figures released in March 2023 were above expectations. The Consumer Prices Index (CPI) rose by 10.1% in the 12 months to March 2023, down from 10.4% in February but above expectations (of around 9.8%).

Inflation remains stubbornly high increasing the likelihood of the MPC raising rates at the next meeting. Capital Economics expects a further 25bps rate rise, from 4.25% currently to 4.5%.

Though labour market conditions have loosened over the past six months, pay growth is likely to remain above that considered compatible with target inflation and thus the MPC is unlikely to start actively cutting rates in the near term.

With interest rates likely to remain higher for longer, financing costs will continue to weigh on investor and developer appraisals, and thus pricing.

Inflation hedging potential will support investment

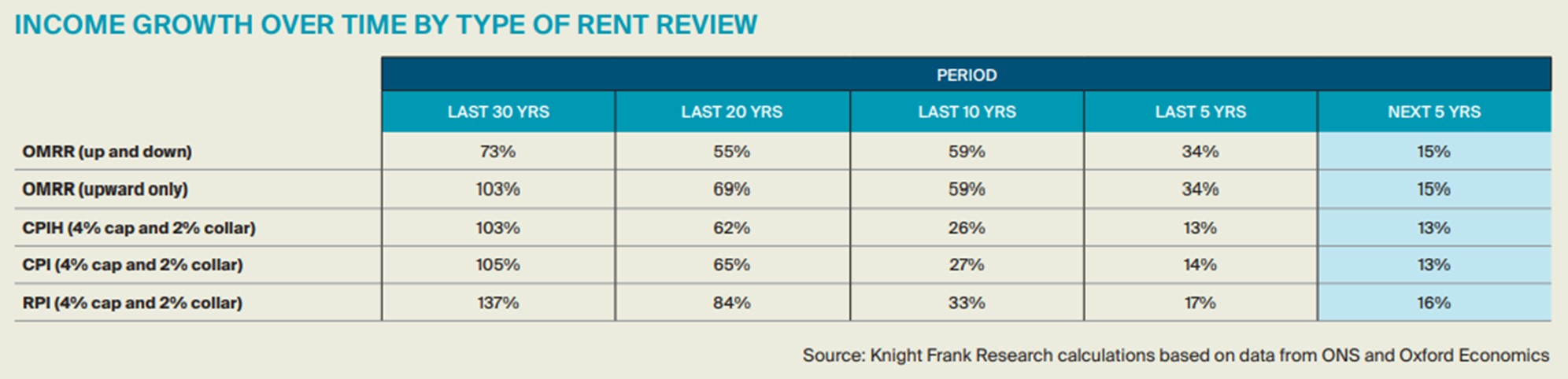

In nominal terms, gilt yields have risen sharply over the last year and the yield gap between them and logistics real estate has narrowed as a result. While this may make the risk-return profile for gilts appear more attractive than logistics, this ignores the impact of inflation. While typical lease structures for logistics assets offer some protection against inflation, conventional gilts do not.

The past year has brought inflation risk back into focus. Many investors may have previously discounted the risk due to a lengthy stretch of low inflation. Prior to the last 18 months, inflation (CPIH) has not exceeded 3% since January 2012 and has not been above 5% since 1992.

While logistics real estate is unlikely to offer a full inflation hedge, due to the cap and collar mechanisms that most leases are subject to, the sector benefits from relatively standardized lease contracts, typically with long lease terms, rent reviews every five years, and strong indexation clauses.

Greater uncertainty around future inflation

Low rates of inflation and strong growth in market rents in recent years have led to an increased preference amongst logistics investors for open market rent reviews. While expectations for future rental growth remain robust, inflation forecasts have risen, and there are risks that inflation could persist.

The latest forecasts from Oxford Economics show an expected CPI of 6.2% for 2023, this is up from a forecast of 2.6% a year ago. While expectations for UK average rental growth have moved from a 4.9% forecast in early 2022, to a 3.6% forecast a year later (RealFor).

The dual impact of both higher CPI and lower rental growth means that landlords need to closely consider the terms attached to (both new and existing) leases when assessing their expected income return.

Future rental growth will vary across geographies and some facilities and locations are likely to see rental growth fall short of inflation over the next few years. Lease structure as well as the specification and location of assets will therefore be an increasingly important consideration for investors.

Read more or get in contact: Claire Williams, head of UK and European industrial research

Subscribe for more

For more market-leading research, expert opinions and forecasts, sign up below.

Subscribe here