New York’s prime rents continue to climb sparking investors’ attention

As investors look to real estate as an inflation hedge, New York’s credentials as a global and transparent market that faces strong tenant demand are back in the spotlight.

1 minute to read

Rents continue to climb sparking investors' attention

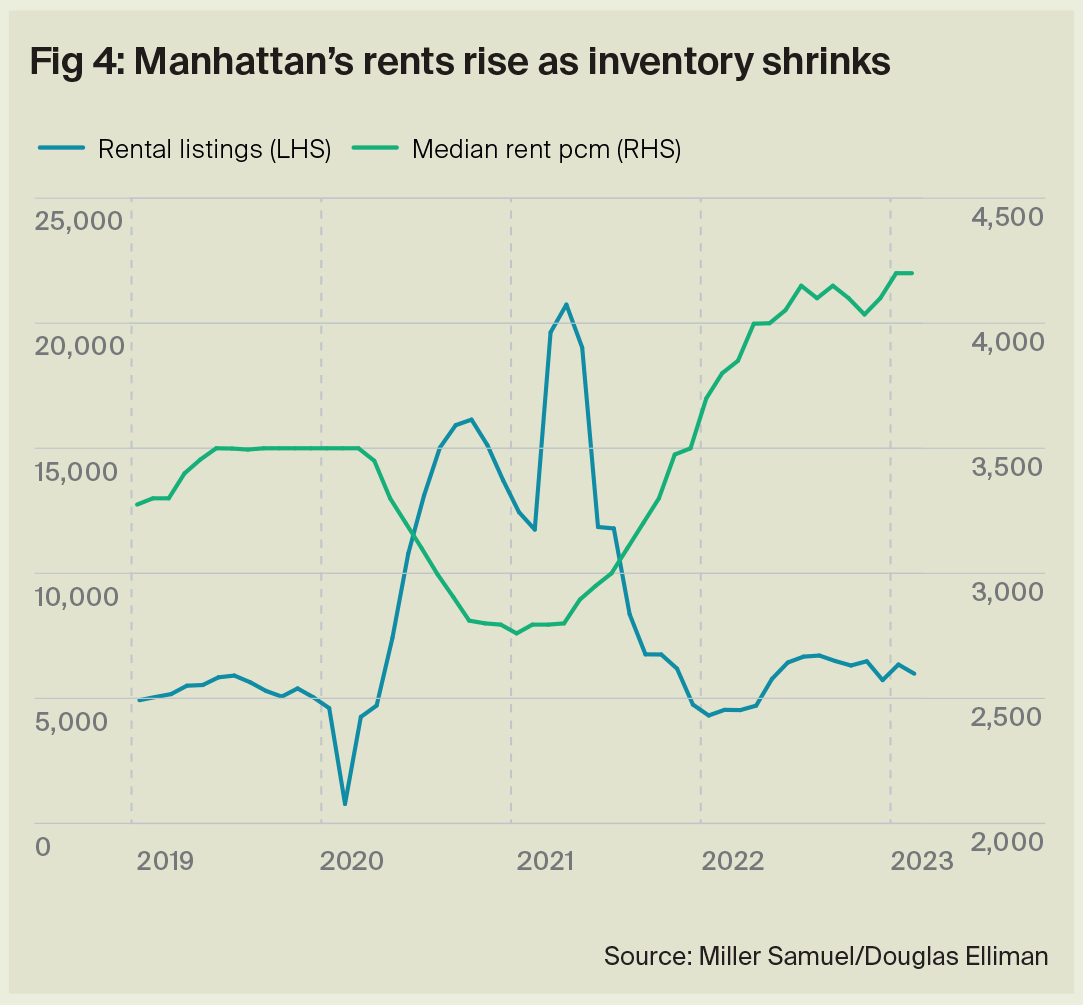

The rental market bounced back strongly following the pandemic. Luxury rents are up 49% since their pandemic low in Q1 2021, and increased 19% in 2022 alone.

A lack of stock persists leaving tenants opting for longer leases. The number of properties available for rent in Manhattan has shrunk from a high of 41,516 in October 2020 to 14,148 in January 2023.

Tenants are looking to lock in for longer whilst mortgage costs remain elevated and rental stock constrained. Two-year leases as a proportion of all Manhattan leases have jumped from around 16% in February 2021 to 42% in January 2023, according to data from Miller Samuel.

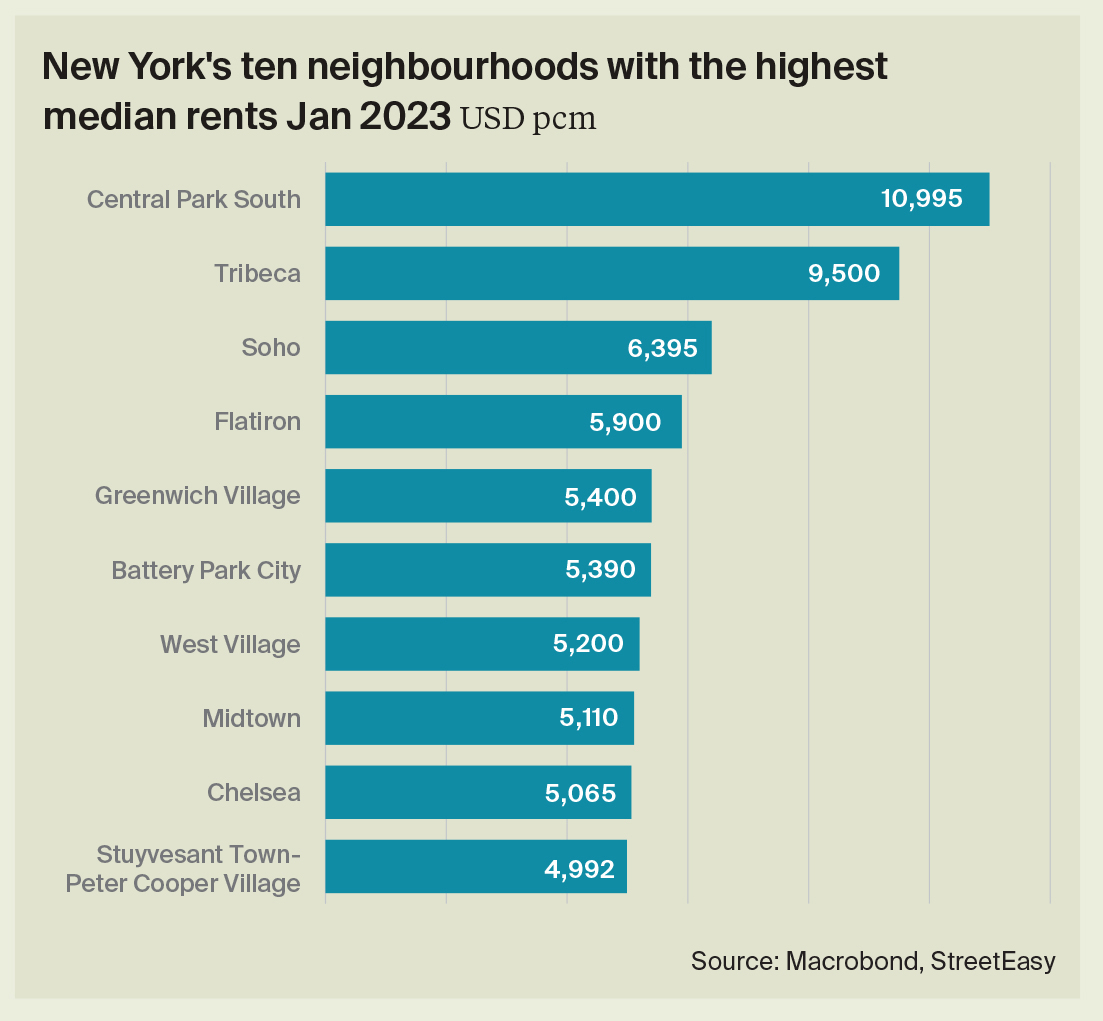

At US$10,995, Central Park South has the most expensive median rents. The fashionable neighbourhoods of Tribeca and Soho sit in second and third place with median asking rents of US$9,500 and US$6,395 per month respectively.

Sign up here to receive future US research and analysis

Photo by Leslie Cross on Unsplash