Cooling property markets

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Cooling

Asking prices for UK homes rose 9.3% in July compared to a year earlier, down slightly from last month, according to Rightmove data out this morning.

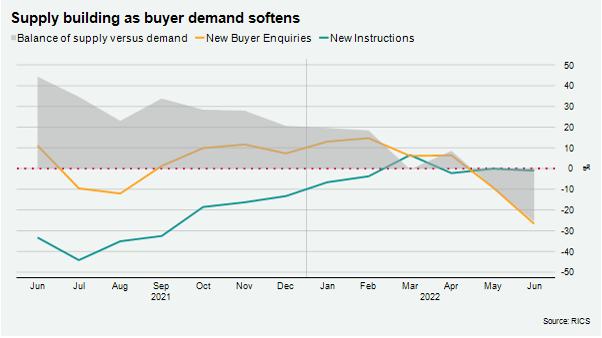

Various indicators now show the market softening, albeit very slowly. Chris Druce has a nice round up here. New buyer enquiries moved further into negative territory in June's RICS Survey, with a net balance of -27% of respondents seeing a fall, down from -9% in May.

New instructions are broadly flat and, for the time being, the amount of property for sale remains tight even with demand softening. That's continuing to exert upwards pressure on pricing, with +65% of survey respondents reporting an increase last month. That will soften as supply continues to build through the coming months (see chart).

The resurgence of city living

Following last year's surge in activity, Scotland’s country market is returning to its seasonal rhythm that sees sales activity peak in the third quarter. There was no change in the average price of a country property in the three months to June, which left average prices 3.9% higher than a year ago.

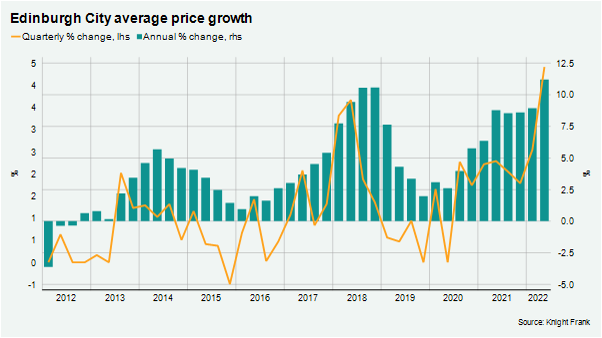

Edinburgh is moving in the other direction amid strong demand for family homes and the resurgence of the flat market. Average prices climbed 4.4% in the three-months to June (see chart). Flats recorded an increase of 4.5% in the second quarter, the strongest performance since the emergence of Covid.

China

Purchasers of new homes at about 100 projects across 50 Chinese cities refused to pay their mortgages last week amid uncertainty as to whether the projects would ever be completed. Regulators have now stepped in to defuse the situation by urging lenders to extend financing to developers.

It's a small respite for a sector that is dragging on China's economy more than any other. Output in the real estate industry shrank 7% in the second quarter from a year ago, according to official figures released over the weekend. In June, home sales fell by almost a quarter compared to the same month a year earlier.

Growth in the broader economy almost ground to a halt in the second quarter, largely reflecting the hit from a two-month lockdown in Shanghai. The 0.4% expansion caps China's worst quarterly growth figure for thirty years.

Opportunities in logistics

Claire Williams updates our House View on the UK logistics market, where an increasingly diverse mix of tenants is picking up some of the slack left by e-commerce operators that have been hit by falling online penetration rates. Preliminary take-up figures show that H1 2022 is down 39% from H1 2021.

The vacancy rate has compressed over the period amid already low levels of supply. Vacancy rates are at historic lows and the limited amount of space available continues to drive rental growth, though it is now slowing. Month-on-month rental growth has slowed from 2.0% in March to 0.9% in April and 0.7% in May.

Claire picks locations where she sees opportunities, most notably those recently granted Freeport status. The business rates relief in these locations could be particularly valuable given the revaluation coming in April ’23, when rates are likely to rise. Those hikes could be significant for some, following an increase in rents of about 30% over the revaluation period. Freeports are well-positioned to attract labour-intensive industries, such as manufacturing, due to the National Insurance relief (zero rate secondary NI contributions). Inflationary pressures and changing supply chains should support demand in these locations.

You can read our House View across a broad set of real estate sectors here.

In other news...

Global central banks ramp up inflation fight (NYT), US inflation expectations survey eases fears of 1% rate rise from Fed (FT), we should worry about price of food more than petrol, warns BlackRock’s Fink (FT), a landmark ruling finds a contractor liable for costs of removing unsafe cladding (Property Wire), Bank of England battle looms over deregulation plan set to prime City for ‘Big Bang 2.0’ (FT), and finally, the ECB case for a half-a-point hike (Bloomberg).