How long can current levels of housebuilding hold?

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

WFH

There are now more job vacancies than unemployed people, according to a remarkable set of ONS figures published yesterday. The unemployment rate at 3.7% is the lowest it's been in half a century.

We talked on Monday about the various indicators suggesting the UK retains a relatively high proportion of employees working from home and the power dynamic implied by these figures is undoubtedly playing a role. Economic growth will slow and the labour market will loosen. Under those conditions we expect employers to begin exerting more pressure to repopulate offices.

That's not to say some level of flexibility won't remain embedded. When compared to other nations, particularly those in Europe, the UK's oversized services sector, its flexible labour market, plus higher commuting costs make it well suited to the adoption of flexible working. However, much remains unknown about its real impact on productivity and until employers know more they are likely to err on the side of caution - that often means leaving significant decisions regarding quantum of space until a lease event.

The fixed nature of leases requires some occupiers to act now - anecdotally, not many are opting for drastic cuts - but the overwhelming majority have the luxury of waiting a year or two, or more. Those will be different conditions in which to be making those decisions: though unemployment might fall even further in the near term, the Bank of England expects the rate to hit 5.5% in three years’ time given the sharp slowdown in demand growth.

Central London offices

Landsec yesterday published its outlook for central London offices within its annual results. The company said office utilisation is growing, especially mid-week, and London is becoming noticeably busier. Its customers increasingly want "flexibility, the best quality space which offers the right amenities to attract talent, and buildings which have the right sustainability credentials."

The group reported record leasing activity, with £63m of leases completed with new and existing office customers, on average 4% above valuers’ assumptions, and a further £6m in solicitors’ hands, 13% ahead of valuers’ assumptions. Over the next twelve months, it expects estimated rental values (ERVs) to grow by a low to mid single digit percentage and the continued weight of capital to keep yields broadly stable.

Construction costs for its committed projects are 97% fixed, but the company has seen c. 5-7% cost inflation on future schemes over the most recent twelve months. The upside to ERVs has offset the impact of rising costs, which it says could "put further pressure on the shortage of prime sustainable space". The company said it could start up to three new schemes with c. £1bn total development cost and an attractive 6.4% yield on cost in the next twelve months.

Inflation

Consumer price inflation surged to 9% in April, according to official figures published this morning. Around three-quarters of the increase in the annual rate this month came from utility bills and your real rate of inflation depends on where you sit on the income scale.

Inflation is now closing in on what the Bank of England believes will be a peak of "around 10%", though it has form on underestimating the scope for further price rises. Responses to a poll of economists conducted by Reuters suggested the cost of living crisis won’t peak until the tail end of this year.

Median responses to the poll show the Bank of England's base rate rising again to 1.25% in June and to 1.50% next quarter before a pause ahead of an increase to 1.75% in the second quarter of 2023.

Housebuilding

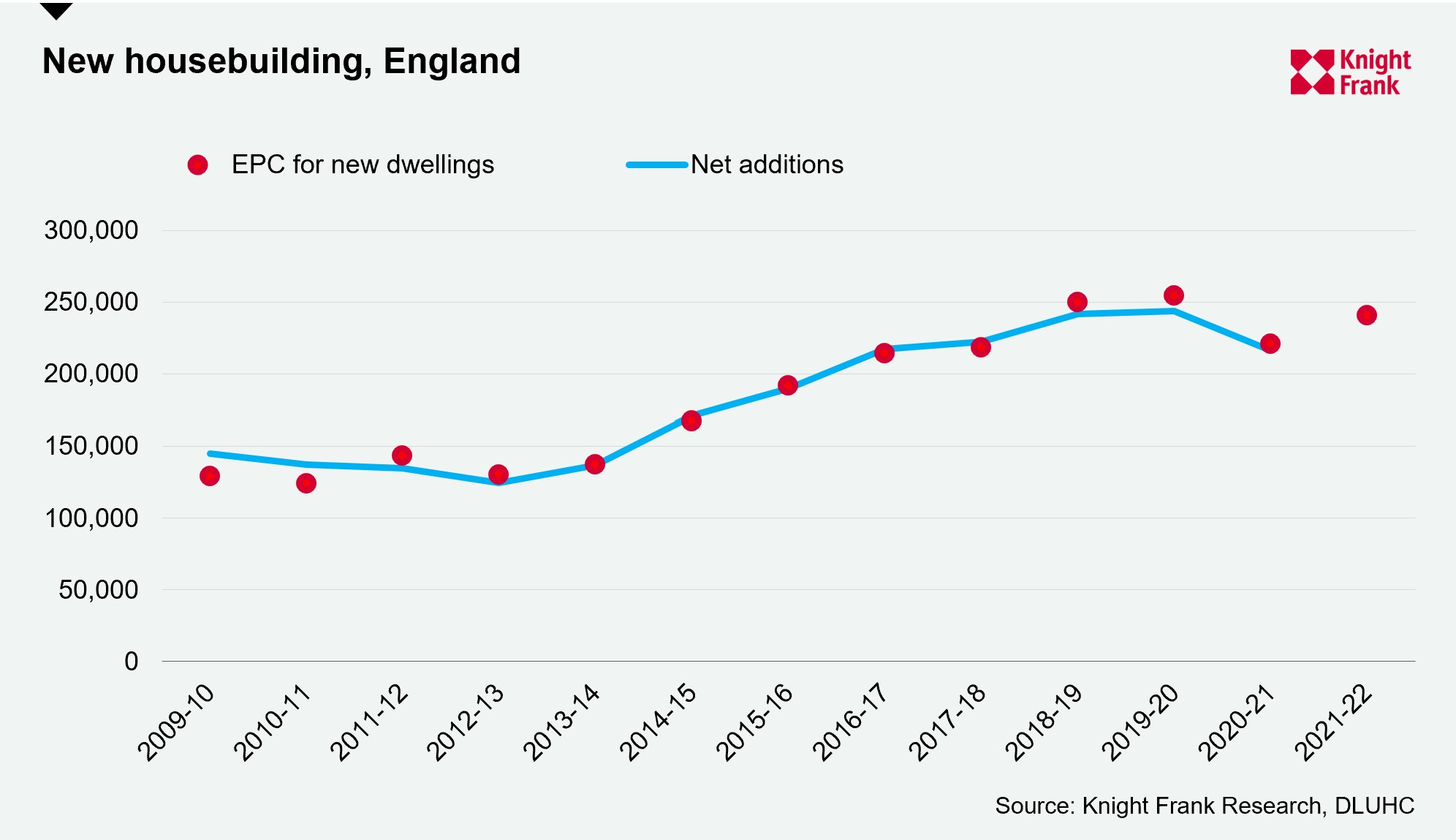

Housing supply was ticking up in England in the run up to the pandemic. While still far below the government’s target of 300,000 homes a year by the mid-2020s, output had eclipsed 240,000 for two consecutive years, marking the strongest output since records began.

All that changed in 2020 as construction firms shut sites during the first lockdown between late March and June. In all, net additions fell 11% to a five-year low of 216,489 in 2020-21.

Historically, Energy Performance Certificates allocated to new homes have proven to be a good forward indicator of supply, as the below chart shows. The latest records show there were 240,944 EPCs allocated in 2021/2022, suggesting high levels of housing demand over the past 12 months have contributed to a return to pre-pandemic delivery rates. This will be confirmed when the government releases its net additions figures later this year.

As Anna Ward notes in this detailed analysis, amid the shelving of planning reform, the looming end of Help to Buy, and ongoing build cost pressures, there are questions as to how long current levels of output will last.

China

In Shanghai, a city of 25 million people, not a single used car changed hands last month.

The statistic is emblematic of the economic destruction caused by China's zero Covid strategy. As Robert Armstrong noted in the FT's Unhedged newsletter yesterday, simultaneously shooting for 5.5% economic growth, a stable debt-to-GDP ratio, and zero Covid-19 is impossible.

Data shows lockdowns squeezing the life out of the real estate market. Property sales by value in April slumped 46.6% from a year earlier, the biggest drop since August 2006, according to National Bureau of Statistics data covered by Reuters. More than 80 cities have taken steps to boost demand since the beginning of the year, but little is likely to change while prevailing policies remain in place.

Interestingly from Bloomberg, China is shopping around for liquefied natural gas shipments, giving rise to speculation that Covid-19 restrictions may be on borrowed time. After months of absence, some of the nation’s LNG importers are inquiring about buying cargoes for delivery from August onward.

In other news...

Bank of England has made 'serious mistakes', former Governor says (Telegraph), Powell says the Fed is watching for ‘clear and convincing’ signs of inflation fading (NYT), China’s lockdowns hammer consumer spending (FT), the rise, fall and rebirth of the shopping centre (FT), and finally, cash is king for big fund managers as global fears pile up (Times).