Los Angeles: Prime prices increased 19% in 2021

Wealth is rising and the US is a key hub of wealth creation. Los Angeles’ luxury property market was one of the world’s top performers in 2021 and is expected to outperform in 2022.

5 minutes to read

In Los Angeles, the shortage of stock will continue to support prices but a lack of inventory – listings fell 50% in December 2021 year-on-year – has the capacity to reduce sales volumes.

Headwinds are also mounting, these include growing wealth inequality, tighter monetary policy as a result of rising inflation and the geopolitical crisis in Ukraine. More muted economic growth looks to be on the cards in 2022. Plus, we expect taxes and cooling measures to increase as policymakers try to curb house price growth and manage pandemic-induced deficits.

Below we highlight some of the latest trends, facts and figures.

1 Wealth is rising

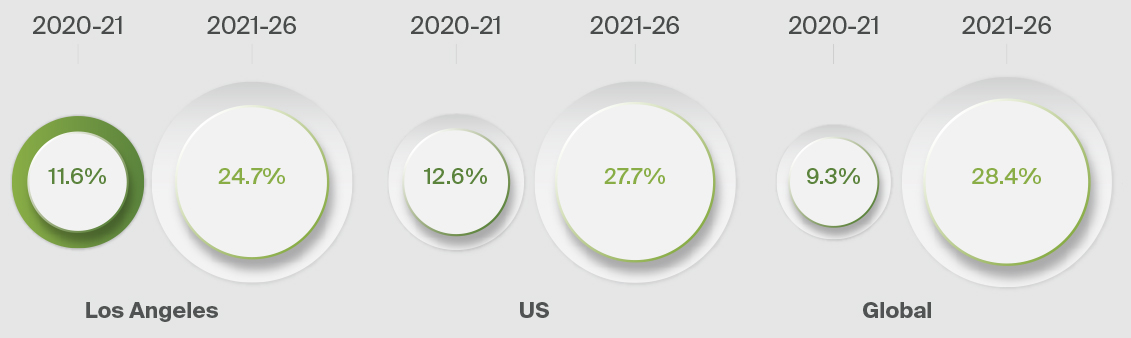

Los Angeles is home to 7,337 ultra-high-net-worth individuals, the fifth highest of any city globally. The figure increased by 11.6% in 2021 and is forecast to rise by 24.7% by 2026. The luxury real estate market was buoyed by the pandemic-induced US economic rebound, the ‘race for space’ and a growing desire to use property as a means of wealth preservation. Domestic demand surged and was supplemented by international buyers when US travel rules were relaxed in September 2021.

2 Inequality is rising

“Wealth creation cannot continue in a vacuum” according to the Taxing Times article in The Wealth Report 2022. The pandemic has widened the wealth inequality gap. Policymakers are therefore taking a closer interest in housing affordability. We expect taxes and cooling measures to strengthen in number and stringency in 2022 as governments look to redress the balance and plug their deficits.

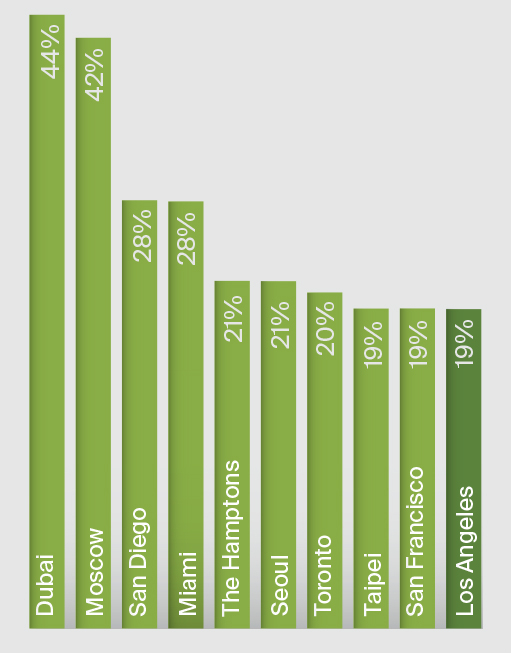

3 Los Angeles registered 19% luxury price growth in 2021

Registering an increase of 19%, Los Angeles was one of the top performers in the 2021 results of the Prime International Residential Index which benchmarks luxury residential prices across 100 of the world’s top markets. Trends identified in 2020 including the rise of co-primary living, the surge in hybrid working and the return of expats all became supercharged in 2021. Add to this strong wealth creation due to economic growth, amassed savings during successive lockdowns, and buoyant equity markets and more wealth was channelled into real estate.

4 $6.3 million, the amount needed to access the top 1% of Los Angeles’s housing market

To enter the rarefied 1% zone in Los Angeles, a buyer would need $6.3 million, the same as in Sydney significantly less than Singapore ($7.3 million) and Beijing ($7.4 million). The values not only reflect market pricing but activity across the whole marketplace. With a higher volume of sales, we can expect to see lower price thresholds.

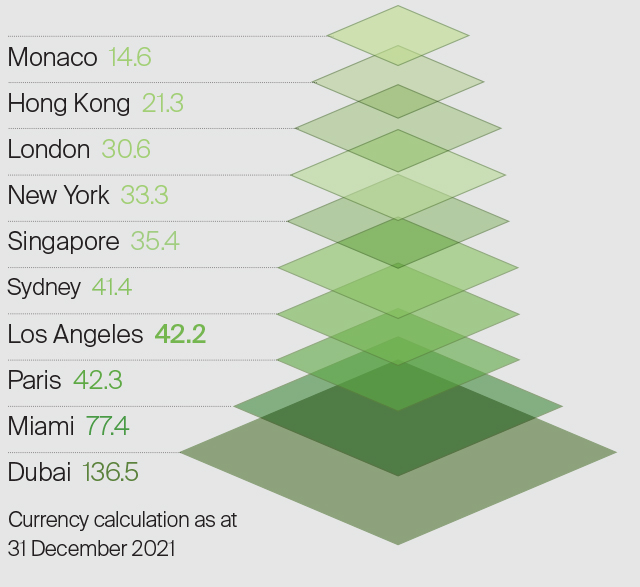

5 $1 million buys 42 square metres of prime property in Los Angeles

Los Angeles’s relative value remains a key draw for buyers, both domestic and international. Based on prime prices at the end of 2021, a million dollars in Los Angeles buys 42 square metres, more space than in cities such as Sydney, Geneva, London and Hong Kong.

6 Prime price growth in Los Angeles will exceed the global average in 2022

Prime prices in Los Angeles are forecast to rise by 8% in 2022, outpacing the global average of 5.7%. Although 8% represents strong growth, it will be a marked slowdown compared to 2021. However, 2021 was an anomaly as the wealthy reassessed their housing requirements on the back of the pandemic and the US economy surged by 5.5%, its fastest rate since 1984. Although the cost of finance is expected to increase as interest rates rise in 2022, the level of wealth accumulation over the past two years will continue to support demand. The 2028 Los Angeles Olympics will act as a catalyst for further investment. Despite minimal new development – there will be no new stadiums and the city's universities will play host to athletes – transport links in the city centre and the LA River project will benefit.

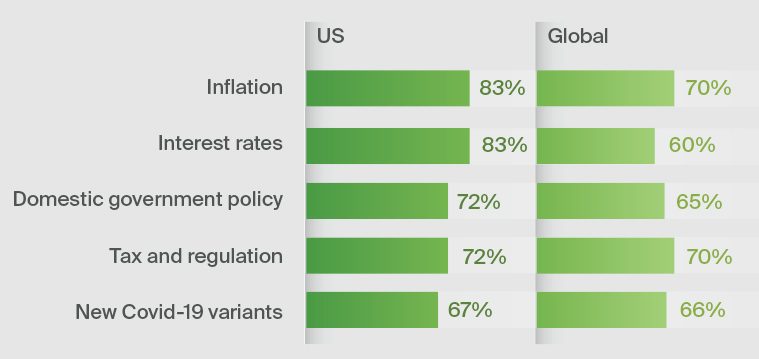

7 Risks are rising

From inflation to interest rates, and from geopolitical conflicts to wealth inequality, risks are mounting. Some 83% of US-based wealth advisors say their clients consider inflation and rising interest rates to be the biggest threats to rising wealth in the US according to The Wealth Report’s Attitudes Survey.

8 Opportunities are rising

Real estate and technological/digital adoption were the two key areas of opportunity for US-based UHNWIs according to The Attitudes Survey. Some 94% of US wealth advisors surveyed considered real estate the biggest opportunity for their clients, significantly higher than the global average of 72%. ESG by comparison was considered marginally less of an opportunity in the US (44%) than it was globally (52%).

9 A lack of stock is Los Angeles' biggest challenge

A shrinking inventory was a concern prior to the pandemic. Covid-19 exacerbated the situation with construction halted or delayed for several weeks in 2020. Inventory levels fell 50.7% in 2021 year-on-year according to Miller Samuel whilst the average number of days a property was marketed prior to sale fell from 53 days at the end of 2020 to 41 a year later underlining the strength of the market.

10 Los Angeles, the fourth most popular global city for the wealthy

The Wealth Report’s City Wealth Index assesses where in the world the wealthy want to live, work and invest. Los Angeles sits in fourth position overall and scores highly for both wealth and lifestyle. In terms of investment, Los Angeles saw a staggering $17.8 billion of private real estate investment in 2021 with home-grown private capital a key contributor.