The conflict in Ukraine, Gove scraps planning reforms and the outlook for mortgage rates

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

How markets and economies fare in the face of the escalating conflict in Ukraine is of little importance relative to the unfolding humanitarian disaster. These are however, the reasons that I assume you read this newsletter, so we will stick to them, leaving commentary on more important issues to those qualified to offer it.

Sanctions

Tough new sanctions agreed over the weekend sent the rouble down more than 30% at the market's open. In response, the Russian central bank hiked its key interest rate to 20%. The dollar, the world's reserve currency, rose relative to all of its peers and Treasury yields tightened sharply.

For an event with no modern precedent, the immediate market response has been orderly. Investors flocked to safe-haven, liquid assets - primarily the dollar - but there were few signs of panic outside of Russian markets. Central banks are likely to continue with plans to tighten policy to combat inflation for the time being. The Federal Reserve, for example, is likely to push on with its scheduled interest rate hike in March, reports the FT, citing former Fed research head David Wilcox.

That's not to say the potential economic implications aren't huge. The clamour we're seeing for liquidity reflects extreme levels of uncertainty over the trajectory of the conflict and the resulting phases of the geopolitical response. It's clear we are moving into a crucial period and investors are putting a premium on the ability to react quickly.

Oscillating geopolitical risks, inequality and inflation were already the most important themes facing the global economy and the conflict has brought them into sharper focus. In preparation for the 2022 edition of the Wealth Report, the team and I spent a year unpicking the data and speaking to experts to find out how they will shape our world over the next twelve months and beyond. I hope you'll join us to share our findings at 9am GMT this Wednesday. You can sign up here.

Property markets

You can find our quick takes on the potential impacts on global residential markets here, and the UK residential market here.

There are unifying themes in both. Altering the pace at which central banks tighten interest rates will be felt most in mainstream housing markets, though there's little evidence so far that central banks intend to change course. Cash buyers, particularly during the pandemic, account for a bigger proportion of sales at the prime end of the market.

Kate Everett-Allen notes that large currency swings will alter cross border capital flows and more generally, investors tend to favour safe haven markets during periods of volatility. In the central London market, we will see a greater push for transparency. The Economic Crime (Transparency and Enforcement Bill) has been fast tracked and will be tabled in parliament on Tuesday, following a package of sanctions aimed at Russia, according to a report from Sky News over the weekend.

Mortgages

The signs that mortgage rates will rise have become unambiguous.

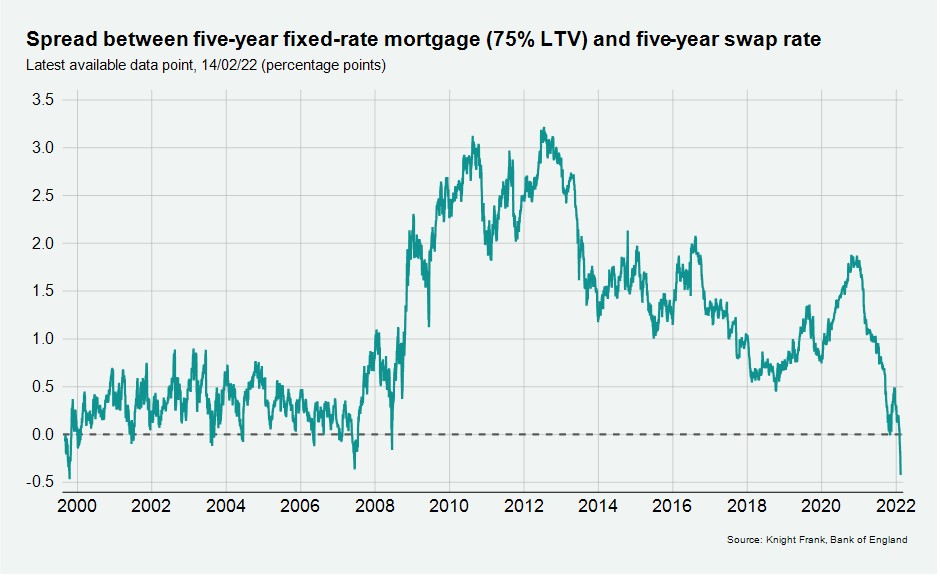

Swaps are financial instruments used by investors to hedge against fluctuating interest rates, enabling them to swap one income stream with a floating interest rate for another with a fixed rate. Lenders price fixed-rate mortgages based on how cheaply they can borrow in the swap market, so swap rates are typically lower than mortgage rates to provide lenders with a profit.

Unusually, swap rates have climbed higher than mortgage rates in recent months, as the below chart shows. This negative spread between the two rates is as wide as it has been since October 1999.

“Financial markets are sending the clearest message in 20 years that mortgage rates are going to rise,” Tom Bill says in his analysis.

Planning

The government's controversial overhaul of the planning system has been scrapped, according to this report in the Telegraph. More limited changes to planning rules will be incorporated as part of a Levelling Up and Regeneration Bill, which will be set out in the Queen’s Speech in the spring.

As Ollie Knight noted at the time, the reforms, though imperfect, were a step in the right direction, however we were sceptical as to how exactly the government would manage to implement so much change - the proposals effectively amounted to tearing up the current system and starting again. I spoke to Knight Frank's head of planning Stuart Baillie over the weekend and he was unsurprised:

“The planning reforms lacked sufficient detail and would have required an incredibly stable Government to implement the necessary legislative change. Frustrations remain about a cumbersome planning system that creates uncertainty of outcome.”

In other news...

A new Rural Market Update from Andrew Shirley, including thoughts on the susceptibility of agricultural supply chains – both in terms of inputs and outputs – to geo-political events.

Elsewhere - government tells housebuilders to ‘go further’ on cladding costs offer (Building), China stimulus fails to jolt construction (Bloomberg), prices are rising so fast that firms can't keep up, Fed survey shows (Bloomberg), BP pulls out of Russia (Times), ‘Most generous’ visas to attract talent and boost productivity (Times), Two of Russia's billionaires call for peace in Ukraine (Reuters), and finally, UK employers nudge up planned pay rises (Reuters).