Inaction bias, green urban deliveries and where London rents are climbing fastest

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Doing nothing…

With the Bank of England due to deliver its decision on whether to raise the base rate tomorrow, the International Monetary Fund yesterday delivered a remarkable warning to officials about "inaction bias" - our tendency to judge taking action as worse than as doing nothing, even if the results are just as harmful.

We've talked before about the BoE's dilemma as it tries to make a call on interest rates amid patchy growth, the emergence of Omicron and runaway inflation. The strong jobs data published yesterday complicates matters further. The IMF sees inflation hitting 5.5% this spring and staying above the BoE's 2% target until early 2024.

The outlook for the economy remains robust, for the time being. The IMF expects growth of 6.8% for 2022 with a mild slowdown in the first quarter before capping 2022 with a 5% expansion. A record two thirds of British households expect the BoE to raise interest rates within the next six months, according to an Ipsos MORI poll published this morning.

Urban deliveries

Approximately 61.5 million square feet of industrial space falls within London's recently expanded Ultra Low Emissions Zone. Claire Williams lays out the impact on occupiers and landlords as they seek to adapt fleets and properties to remain competitive.

Demand from customers for faster delivery times and the ability to select delivery windows is driving companies away from a few large-scale units to more numerous, smaller properties. Landlords now need to offer amenities such as cargo bike parking and EV charging points, which is changing fit-out requirements.

The transition towards sustainable delivery models is offering competitive advantages, with traffic congestion in city centres meaning that bicycles, e-bikes or mopeds are a faster delivery option compared with vans. Where vehicles are necessary, greener fleet vehicles are driving demand for alternative fuels. Gasrec recently appointed Knight Frank to accelerate site acquisitions across the UK for biomethane fuelling stations. Sustainable alternatives to natural gas will allow retailers and logistics businesses to reduce vehicle emissions by up to 95%

London rents

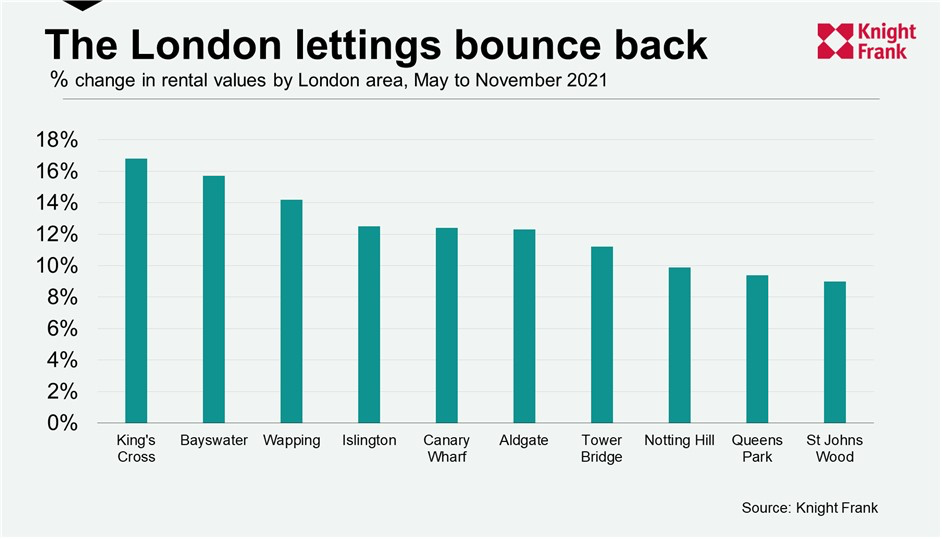

London rental values are rebounding as offices and universities re-open. Meanwhile, supply has fallen as the flood of short-let properties that came onto the long-let market has dried up.

Tom Bill reveals which areas have seen the strongest growth over the last six months (see chart).

King’s Cross leads with growth of nearly 17%, underlining the strength of student demand. Nearby universities include Central Saint Martins, University College London and King’s College London. Bayswater takes second, partly down to the ‘escape to the country’ trend as renters with homes in the country seek apartments close to Paddington. Wapping and Canary Wharf come in third and fifth, driven by workers seeking a base close to the office. We would expect that trend to continue if further lockdowns are avoided.

Green homes

The energy efficiency of the English housing stock continues to improve, though the scale of action needed to hit the government's net zero targets remains huge.

The proportion of dwellings in the highest EPC bands A to C has jumped from 14% in 2010 to 46% in 2020-21, according to the English Housing Survey, published late last week. Over the same period, the proportion of dwellings in the lowest three bands (E,F and G bands) has fallen from 39% to 10%. In 2020, the majority of dwellings (87%) were in bands C or D, compared with 61% in 2010.

The government is aiming for all houses to achieve EPC band C by 2035.

Help to Buy

The latest Help to Buy data, also published late last week, reveals there were 10,824 completions in Q2 2021, down 27% compared with the same (pre-covid) quarter of 2019 and 39% lower than Q2 2018.

This is the first quarter of data at least partially related to the new, tighter eligibility, including regional price caps and restriction of the scheme to first time buyers. New build sales rates are still generally pretty good, but it’s an indication of the challenge faced by housebuilders once the scheme comes to an end.

In other news...

London hotels delivered their highest level of profitability since the start of the pandemic during October. Philippa Goldstein weighs the outlook in light of Omicron.

The UK residential property market continues to defy gravity: a new monthly outlook from Chris Druce.

Elsewhere - unemployment falls despite end of furlough scheme (Times), Morgan Stanley chief James Gorman admits he was wrong on return to the office (Times), Goldman and JPMorgan plan bumper bonuses for investment bankers (FT), investors pour billions into inflation-linked assets (FT), battle of the streamers sparks real estate frenzy (FT), China's property-led economic slump sparks calls for new stimulus (Bloomberg), Singapore home sales hit a four-month high (Bloomberg).