Sapling shortage, green lending, Kenyan farming

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

5 minutes to read

To coincide with the ongoing COP26 talks, this week’s update has a climate change and sustainability flavour. As highlighted by a few of the articles below, it’s fascinating that the solution to reducing carbon emissions and coping with changing climatic conditions, whether being practised by small-scale farmers in Africa or on traditional estates in the UK, is remarkably similar – look after your soil and it will look after you. And that still makes perfect sense regardless of your views on manmade climate change. It’s a shame that there was no specific focus on agriculture at COP26, but governments around the world need to ensure that farmers are actually being listened to and that organisations are making the space for them to drive the change they want to see with regard to food systems. Do read my interview with Jack Ord of charity Hand in Hand. It’s about farming in Kenya, but I think many of his points will resonate with food producers in the UK, too.

Do get in touch if we can help in any way

Andrew Shirley, Head of Rural Research

In this week’s update:

• Commodity markets – Grain goes higher, but dairy farmers needs more

• Agricultural lending – low rates and green deals

• Trees – Sapling shortage hits reforestation aspirations

• Regenerative farming – Knight Frank client shares 100-year vision

• The Rural Report – Sign up to watch our ground-breaking video

• Overseas news – I discover how the charity is working with climate change

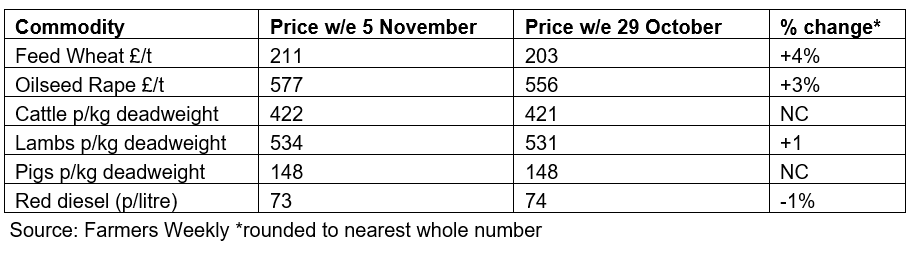

Commodity markets – Grain goes higher, but dairy farmers needs more

Wheat and oilseed markets continued to climb last week, but their contribution to higher on-farm costs (in conjunction with many other factors such as rising energy costs) in the dairy sector mean consumers will need to get used to paying higher prices for their milk. A new report from Kite Consulting says that the cost of production for dairy farmers next year will hit around 34p/litre, significantly higher than the price they are being paid. If costs are not passed on to the consumer “we ultimately risk the collapse of UK food supply chains” claims the report.

Agricultural lending – Low rates and green deals

Although the Bank of England’s Monetary Policy Committee voted in favour of holding interest rates at just 0.1% last week, it hinted that it will raise them to 0.25% soon, perhaps as early as December, points out my colleague Rachel Barnett, an agricultural lending specialist at Knight Frank Finance.

While it is unlikely that rates will increase to 1% by the end of next year, we could see an increase to 0.5%, she reckons.

Rachel still has access to an extremely competitive seven-year fixed rate at 1.49% for clients and sub 2% rates are still achievable for financing commercial projects. But she says these rates will not be around for much longer.

Lenders are doing more to support projects with green credentials, such as offering lower rates and no fees. Rishi Sunak’s announcement at COP26 that most big UK firms and financial institutions will be forced to say publically how they intend to hit climate change targets by 2023 could exacerbate this trend.

Please contact Rachel If you are considering borrowing for a project, acquisition or would simply like a review of current borrowing arrangements.

Trees – Sapling shortage hits reforestation aspirations

One of the big-ticket deals to be announced at COP26 was the commitment by 133 countries to: “….commit to working collectively to halt and reverse forest loss and land degradation by 2030 while delivering sustainable development and promoting an inclusive rural transformation.”

However, according to reports across the media the UK is going to struggle to hit its own tree-planting targets due to a shortage of native species saplings at tree nurseries, apparently exacerbated by a lack of labour due to Brexit. The dearth could mean some applicants to tree-planting projects will not receive their grant funding as they won’t be able to plant the required trees by scheme deadlines.

But, speaking at the recent NFU Scotland conference, President Martin Kennedy criticised climate-change and carbon-market driven “….wholescale farm plantings that take out not only good agricultural land, but also the people who are the life and soul of the community”.

For advice on tree-planting schemes please email Edward Holloway of our Forestry Investment team.

Regenerative farming – Knight Frank client shares 100-year vision

A recent edition of Radio 4’s On your Farm visited the Bradford Estate in Shropshire where my colleague Tom Heathcote has been offering some strategic advice on the switch to regenerative agriculture. It’s a really interesting episode and well worth a listen to hear about the long-term approach to tackling climate change and revitalising soils being adopted by one of the UK’s most forward-thinking estates.

The Rural Report – Sign up to watch our ground-breaking video

This year’s edition of The Rural Report, our unique publication for rural landowners and their advisors, launched last month with a video highlighting some of its key content around the topic of ESG. If you missed it, you can sign up to watch on demand at your leisure. It was a lot of fun making it and includes a thought provoking interview on diversity, with Wilfred Emmanuel-Jones AKA The Black Farmer. I think you’ll find it both entertaining and informative.

Sign up to watch The Rural Report launch video

Overseas news – I discover how the charity is working with climate change

The world’s poorest farmers are the most affected by climate change, yet contribute to it the least. In this interview with a programme manager at Hand in Hand international I discover what the charity is doing to help Kenya’s small-scale producers affected by increasingly frequent floods, droughts and plagues of locusts. The solutions such as regenerative agriculture and a return to circularity are remarkably similar to the discussions we are having with our clients in the UK (see article above).