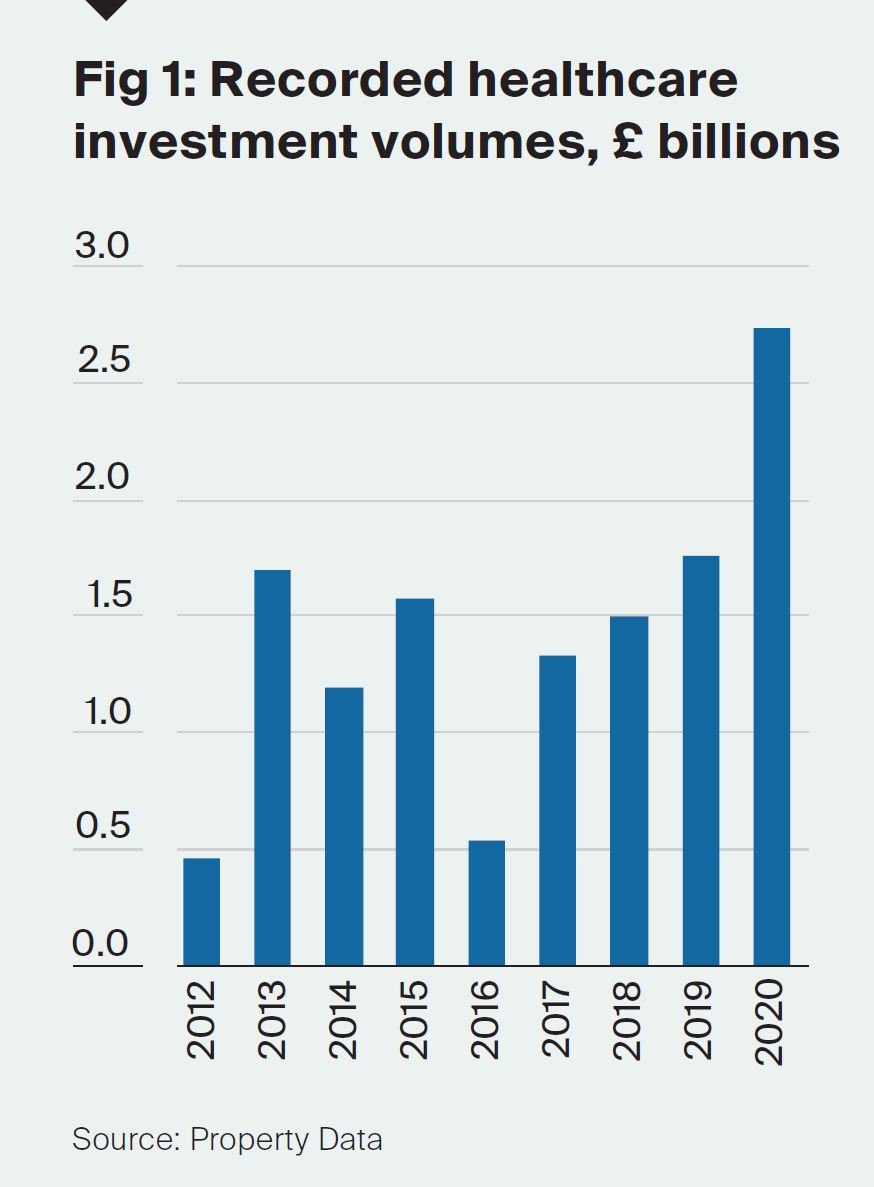

Healthcare property investment hits record levels

£2.7 billion of transactions were recorded in 2020, despite the challenges of the pandemic.

2 minutes to read

While it’s undoubtedly been a tough year for many healthcare operators across the UK, the level of capital directed at the sector suggests investors remain undeterred. 2020 saw some highly some significant portfolio deals within traditional healthcare sectors like private hospitals and care homes, but there has also been growing activity in more specialised subsectors, including assets supporting mental health, disability housing, childcare and specialist schools.

The breadth of assets within healthcare is matched by a growing breadth of investor types. This includes an increasing weight of institutional capital, a strengthening selection of real estate investment trusts (REITs), and intensifying demand from overseas investors targeting UK healthcare. All of these investors see healthcare property as an asset underpinned by secure long-term prospects and stable returns.

Overseas buyers accounted for 72% of acquisitions in 2020. The most significant deals were focused on the private hospital market, capital supplied by North American REITs whose acquisitions look well-timed. The dollar has since weakened against the pound and the NHS is expected to lean heavily on the private hospital sector in 2021 in the aftermath of Covid-19.

The pandemic has also fuelled greater investor interest in specialist healthcare sectors such as mental health, learning disability, children’s nurseries and specialist schools. These sectors are focused on users below the age of 65, and therefore Covid-19 has had less of an impact. Growing interest in specialist healthcare sectors is also a product of the growth in ESG or socially impactful investing, spearheaded by a number of infrastructure funds.

Strong appetite for healthcare real estate is expected to continue in 2021 with more investors seeking the safety and security provided by long-dated income, such as that provided by the UK healthcare market. More investors are also looking to re-weight asset allocations out of retail and into alternative sectors – an ongoing trend that may have been accelerated by the pandemic.