The investment case for Senior Housing

Investment into the UK later living market has risen markedly in recent years, but what does the future hold?

5 minutes to read

The last few months has had a significant impact on all of our lives, but has placed a particular spotlight on people in later life. People generally wish to live independent lives as long as possible and it is vital that we provide age appropriate housing options to seniors. The need to address this issue is pressing, with demand only increasing as people live longer. Well-designed extra care retirement communities provide people with a housing option that delivers a good standard of independent living while also ensuring that high quality care and support is available when required. Operators have professional teams trained to manage the properties and keep both residents and staff safe.

Covid-19

Despite recent weeks of temporary muted activity enforced by the lockdown, we have seen positive sentiment continue especially amongst institutional investors. Clearly the full impact of Covid-19 on the sector has yet to become evident. However, the strong fundamentals underpinning investment have not changed.

The Covid-19 pandemic will result in a re-ordering of decision making priorities for tenants and residents. Topics like infection prevention and control will drive demand and require a look at how new schemes are designed as well as staffed and managed. This in turn will lead to a greater desire from investors for professionally managed buildings with an operational focus.

The investment case

The investment case remains compelling:

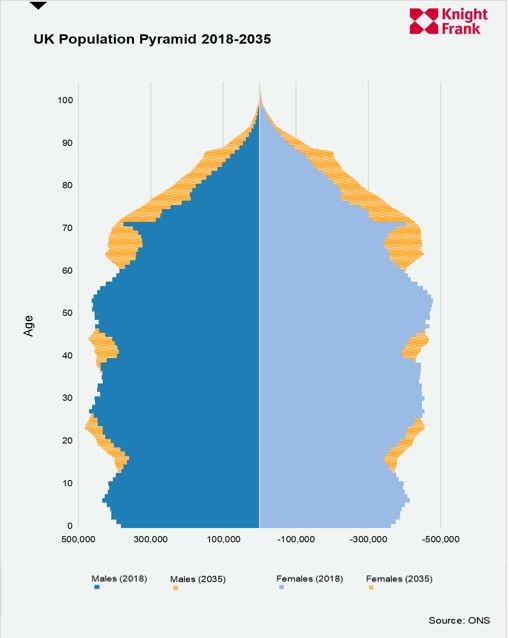

- Underlying demographic trends underpinning the sector will continue - the UK’s population is ageing. By 2037, it is forecast that 13% of the population will be aged 75+, an increase of almost 60% from today.

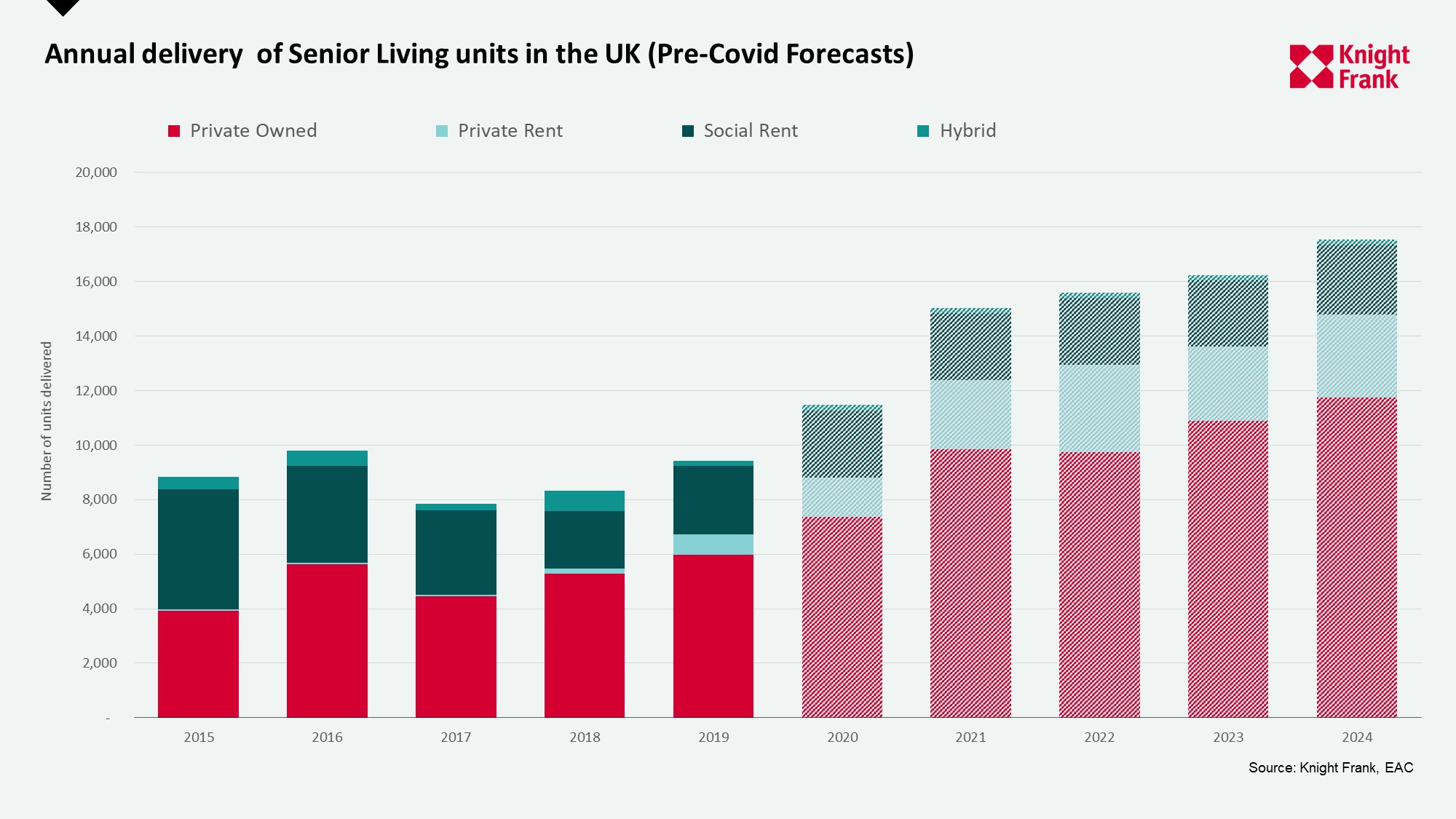

- There is a substantial imbalance between the rate our population is aging and the delivery of seniors housing with only 9,500 senior living homes completed in the UK in 2019.

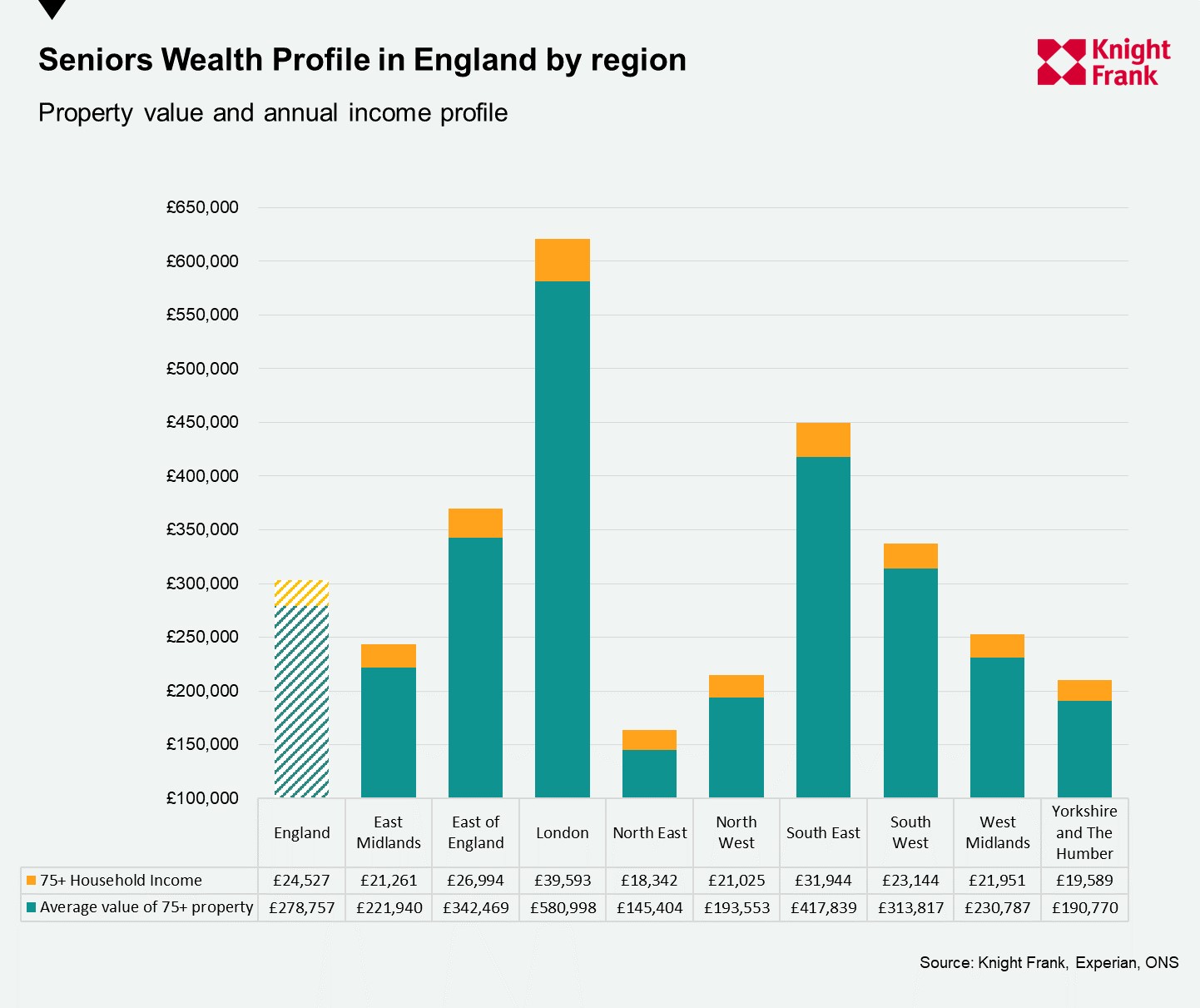

- Our senior population represents the wealthiest demographic in terms of property values. The fundamentals of affordability are based on this property wealth, alongside income from pensions and investments.

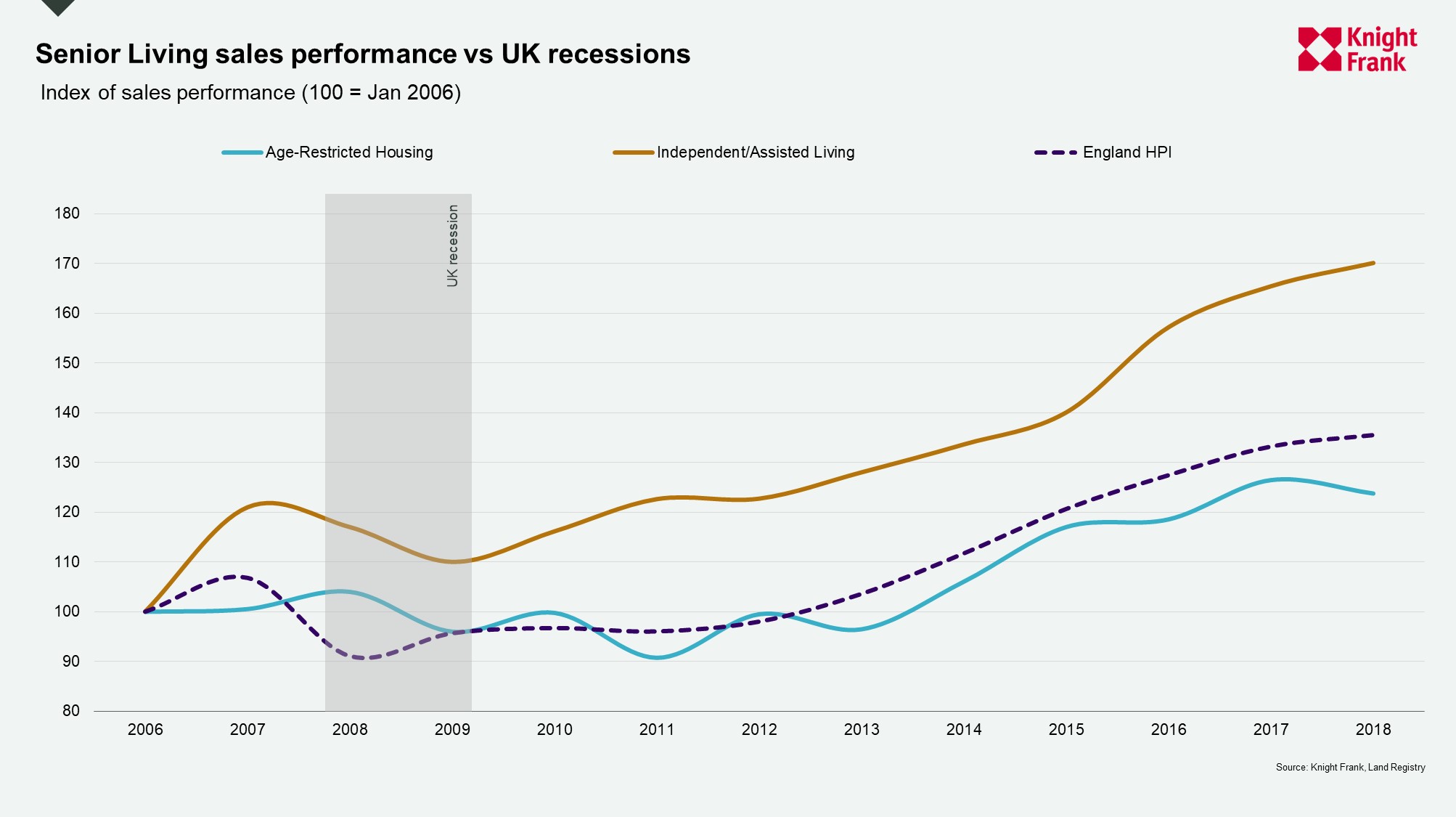

- Price growth for independent living and assisted living properties outstrips mainstream residential. Our analysis indicates price growth within the sector stands at 55% since 2009 compared to average house price inflation across England of 42% over the same period.

Investment into the UK senior housing market has increased over the last few years. This increase reflects the relative immaturity of the sector as well as its potential in the eyes of an increasing number of investors. The sector is currently in a development phase, with between 8,000-9,000 new senior living units delivered in the UK annually.

In 2019 we forecasted that the total GDV (gross development value) of private schemes in the senior living sector would rise from £39bn in 2019 to £55bn by 2023, with growth underpinned by demographic shifts and increased investment from both the UK and overseas. Given the current Covid-19 pandemic, the question now is how resilient is the sector in both the short and long term? Certainly, 2020 started where 2019 ended, with investment in the first quarter - before the pandemic took hold across the UK and government restrictions on movement were introduced - totalling £430m.

Supply pipeline

Analysis of the supply pipeline suggests that nearly 11,500 units were due to be delivered this year, increasing year on year to a total of just below 70,000 by 2023. However, a hiatus in construction activity with restrictions on access to development sites with Covid-19 restrictions, will apply further pressure on what is already widely regarded to be an undersupplied market.

Tenant demand

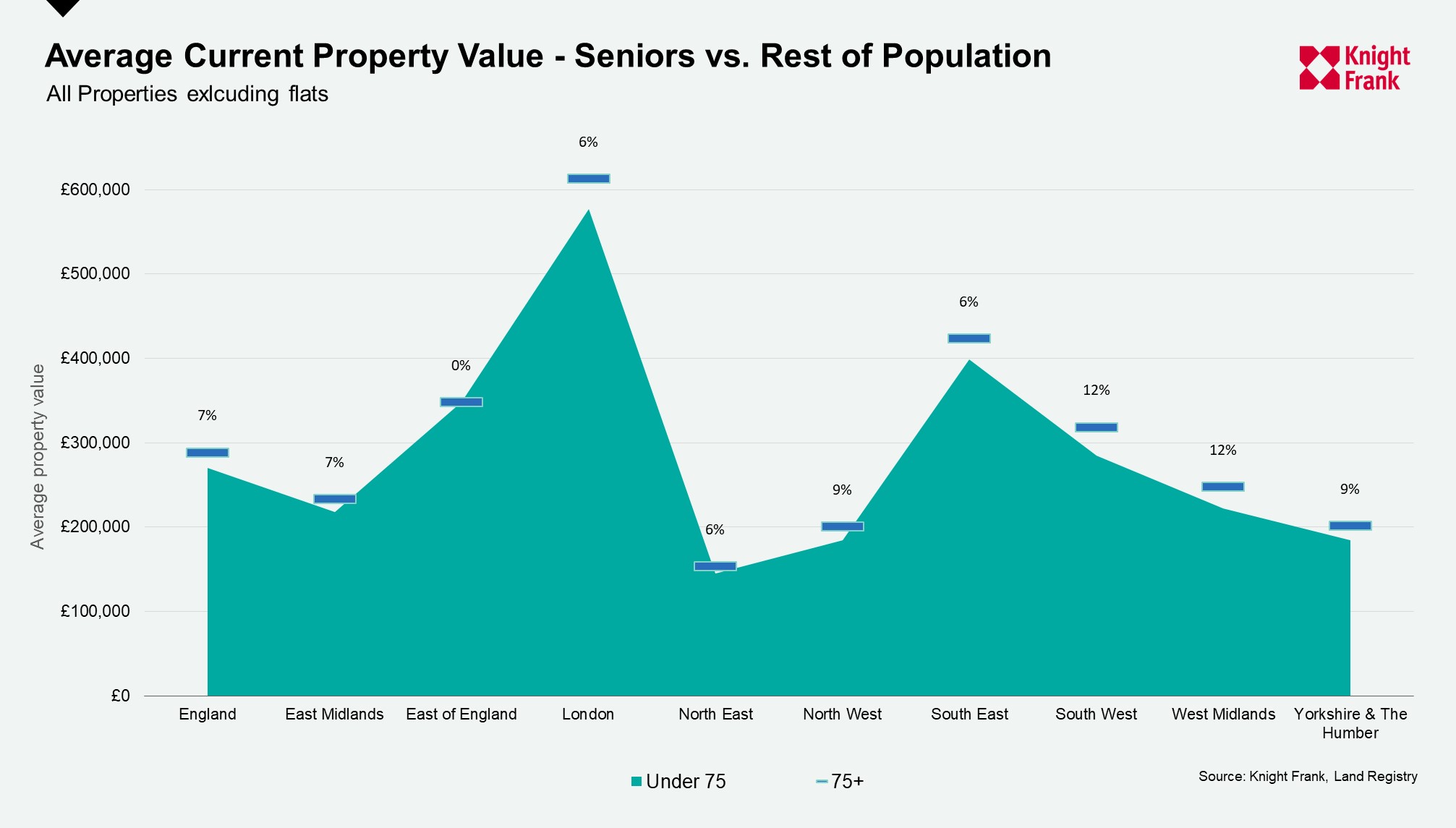

It is also worth noting, that the demographic trends which underpin the sector are unchanged. The UK’s population is ageing and is projected to continue to age. The number of people aged 75+ living in the UK is forecast to increase by 49% to almost 8.5 million by 2035. This growing senior population also represents the wealthiest demographic in terms of property values. Our in-house estimates suggest the average value of a house owned by a senior household is almost £280,000, some 8% higher than the average values for those under-75.

Affordability

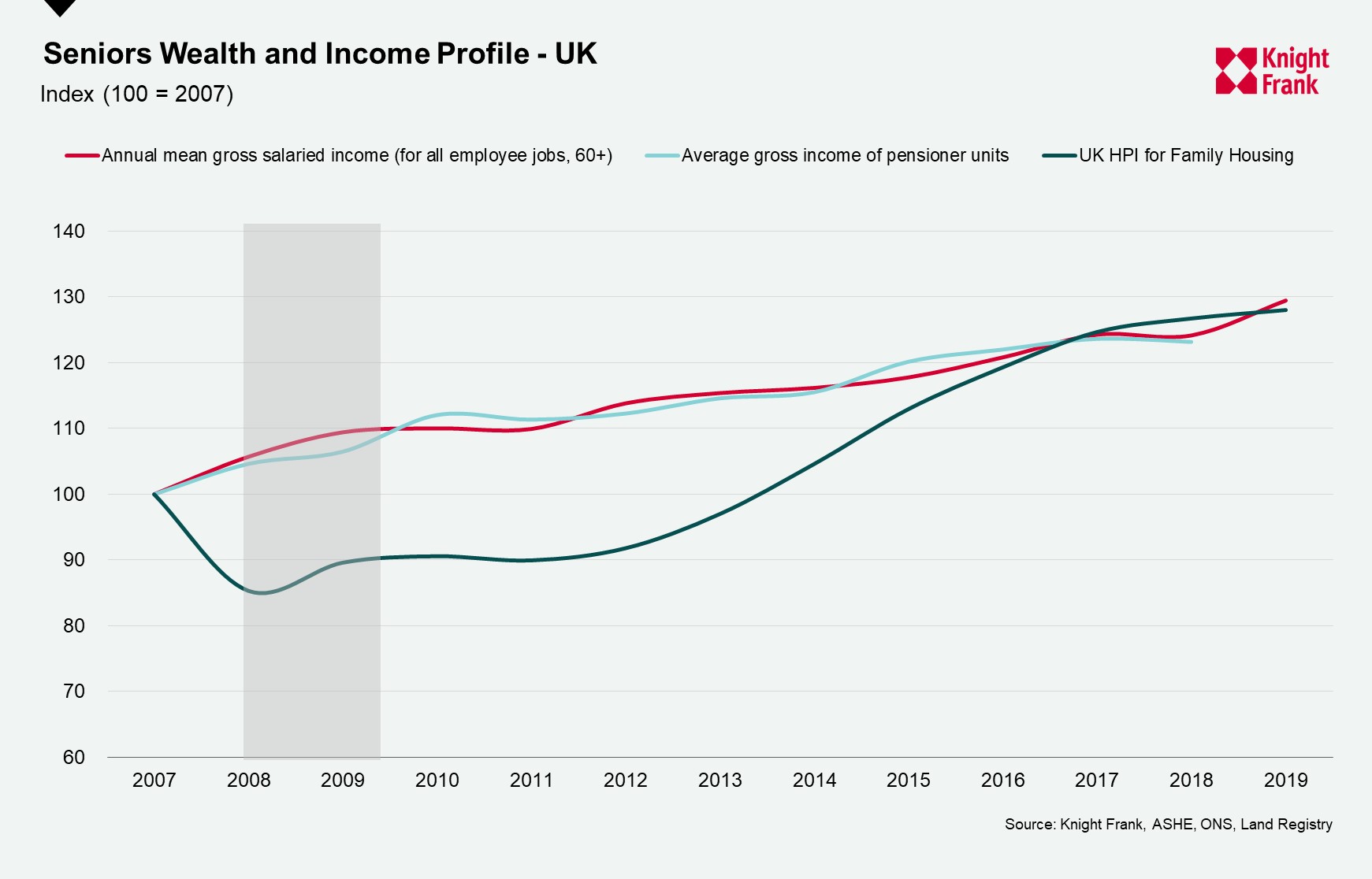

The fundamentals of affordability are based on property wealth, alongside income from pensions and investments, with seniors able to draw on a number of pools of capital in order to fund a move, a benefit that much of the younger generations do not have. Historic trends suggest this wealth is only going to increase. During the 2007/08 and 2017/18 period, UK house prices increased on average by 22%, with the gross income received per week from all pension plans increasing by 11% according to DwP, driven by substantial growth in occupational personal income.

Outlook

The Covid-19 pandemic will likely speed up existing trends in the sector including:

- Larger schemes with the capacity to provide a range of services, providing flexible access to seniors housing, and offset increases in staffing and operational costs;

- Closer proximity to urban locations, developing mixed-use schemes and re-purposing sites currently in other land uses, such as retail;

- Independent living schemes offering increasing numbers of medically trained staff which will enable such schemes to incorporate assisted living alongside independent living;

- Increasing mixed tenure and rental-only propositions, as well as more variations of event fee structures providing increased tenant choice best suited to their financial profile, budget and preference;

- Higher levels of staff training, larger stocks of PPE equipment and higher scrutiny of supply chains;

- Closer alignment with epidemiologists and the wider use of telehealth to better utilise technology in the provision of better care and servicing of residents.

However to continue moving into a mainstream asset class there are still concerns and issues that need clarifying. Including a uniform plan for meeting the housing needs of our aging population is required with local authorities held to account to meet local need. Seniors housing should be given support in planning policy and considered equally as important as affordable housing. And wider understanding of the benefits of seniors housing including financial savings to local authority care services, release of local family housing back to the market via downsizing, local employment generator, reduced impact on highways and other local services, rejuvenating high streets with facilities open to the public, and lastly contributing to housing supply targets.

For more information, please contact Tom Scaife or Lauren Harwood.